USDA Semi-Annual EU Dairy Production Report

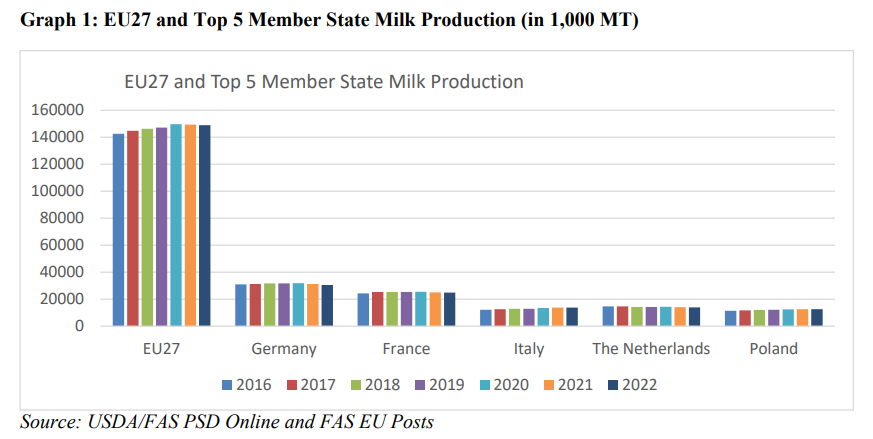

Cow numbers in the EU27 have decreased by more than 1.4 million head since 2016, including a loss of 800,000 head since 2019. Continued year on year increases in milk productivity are unable to compensate for this loss of dairy cows and the EU27 cow milk production forecast for 2022 is now 144.6 million MT (MMT), a decrease of 434,000 MT compared to 2021 and 836,000 MT down from 2020. EU dairy industry experts expect EU milk production to decline further in 2023 and after, when the new Common Agricultural Policy (CAP) and the accompanying Farm to Fork Strategy (F2F) conditionalities require EU dairy farmers to adjust their production systems.