U.S. Dry Product Stocks Update – Feb ’15

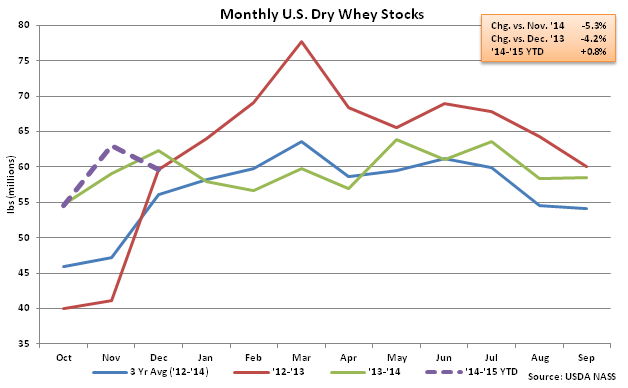

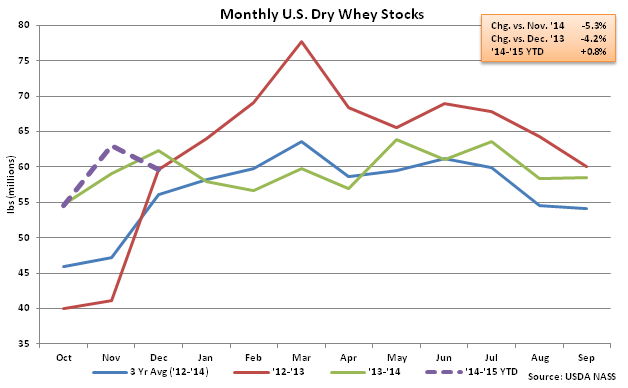

Dry Whey – Stocks Decline YOY for 11th Time in Past 12 Months

Dec ’14 dry whey stocks declined by 5.3% MOM, or 3.4 million lbs, to a total of 59.7 million lbs. Dec ’14 dry whey stocks also declined 4.2% YOY, which was the 11th monthly YOY decline in the past 12 months. Despite the YOY declines, stocks remain 15.4% higher than the five year average December dry whey stocks.

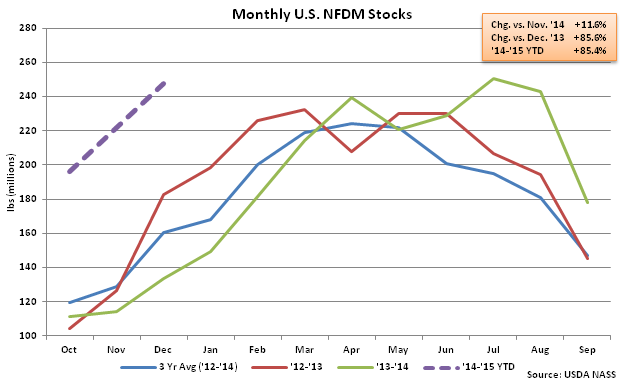

NFDM – Stocks Remain Significantly Higher on YOY Basis

Dec ’14 NFDM stocks increased seasonally by 11.6% MOM, or 25.7 million lbs, to a total of 247.4 million lbs. The 25.7 million lb November – December increase in NFDM stocks was consistent with the five year average November – December increase of 25.8 million lbs. Dec ’14 NFDM stocks were up 85.6% YOY which was the second largest YOY percentage gain in seven and a half years, trailing only the previous month. Stocks were 63.0% higher than the five year average December NFDM stocks.

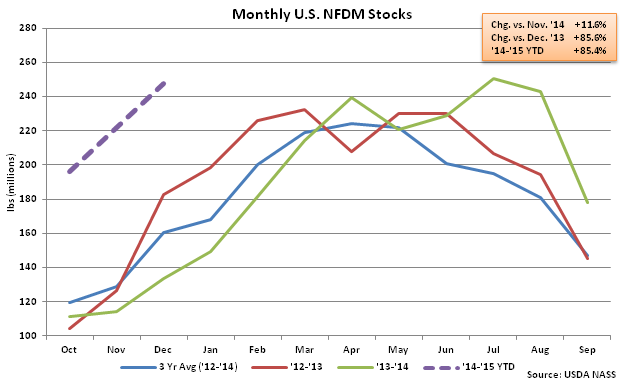

NFDM – Stocks Remain Significantly Higher on YOY Basis

Dec ’14 NFDM stocks increased seasonally by 11.6% MOM, or 25.7 million lbs, to a total of 247.4 million lbs. The 25.7 million lb November – December increase in NFDM stocks was consistent with the five year average November – December increase of 25.8 million lbs. Dec ’14 NFDM stocks were up 85.6% YOY which was the second largest YOY percentage gain in seven and a half years, trailing only the previous month. Stocks were 63.0% higher than the five year average December NFDM stocks.

NFDM – Stocks Remain Significantly Higher on YOY Basis

Dec ’14 NFDM stocks increased seasonally by 11.6% MOM, or 25.7 million lbs, to a total of 247.4 million lbs. The 25.7 million lb November – December increase in NFDM stocks was consistent with the five year average November – December increase of 25.8 million lbs. Dec ’14 NFDM stocks were up 85.6% YOY which was the second largest YOY percentage gain in seven and a half years, trailing only the previous month. Stocks were 63.0% higher than the five year average December NFDM stocks.

NFDM – Stocks Remain Significantly Higher on YOY Basis

Dec ’14 NFDM stocks increased seasonally by 11.6% MOM, or 25.7 million lbs, to a total of 247.4 million lbs. The 25.7 million lb November – December increase in NFDM stocks was consistent with the five year average November – December increase of 25.8 million lbs. Dec ’14 NFDM stocks were up 85.6% YOY which was the second largest YOY percentage gain in seven and a half years, trailing only the previous month. Stocks were 63.0% higher than the five year average December NFDM stocks.