Dairy WASDE Update – Mar ’20

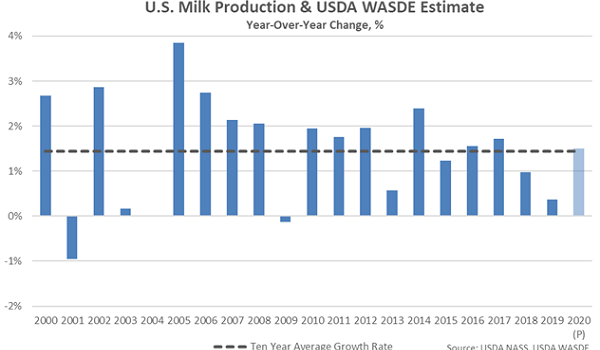

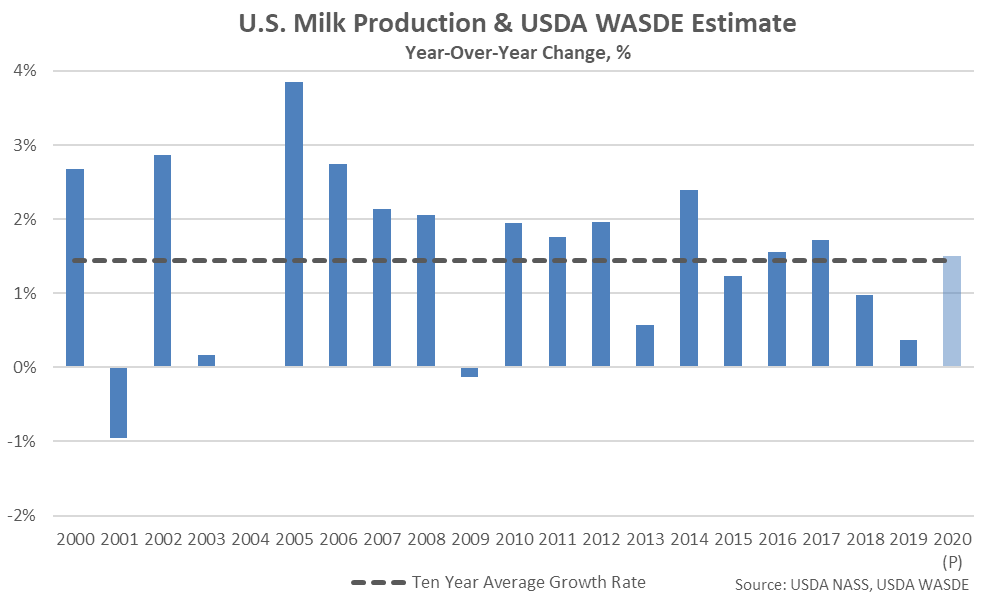

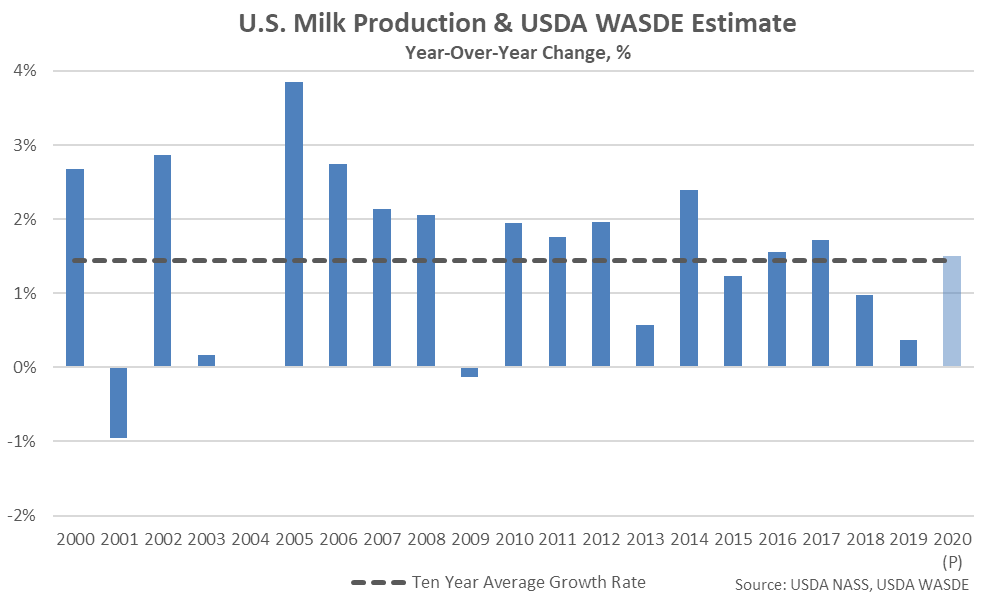

According to the March USDA World Agricultural Supply and Demand Estimate (WASDE) report, the 2020 U.S. milk production projection was increased 300 million pounds from the previous month on a higher expected cow inventory, rebounding to a three month high projected level. 2020 projected milk production equates to a 1.5% YOY increase from 2019 production levels, finishing slightly above ten year average figures.

2020 dairy export forecasts were reduced from the previous month on a milk-fat basis on slower anticipated demand in the first half of the year but raised on a skim-solids basis on expectations of continued strength in international demand.

2020 dairy import forecasts were raised from the previous month on both a milk-fat and skim-solids basis on recent trade data and stronger anticipated imports of butterfat, cheese, milk proteins and several other dairy products.

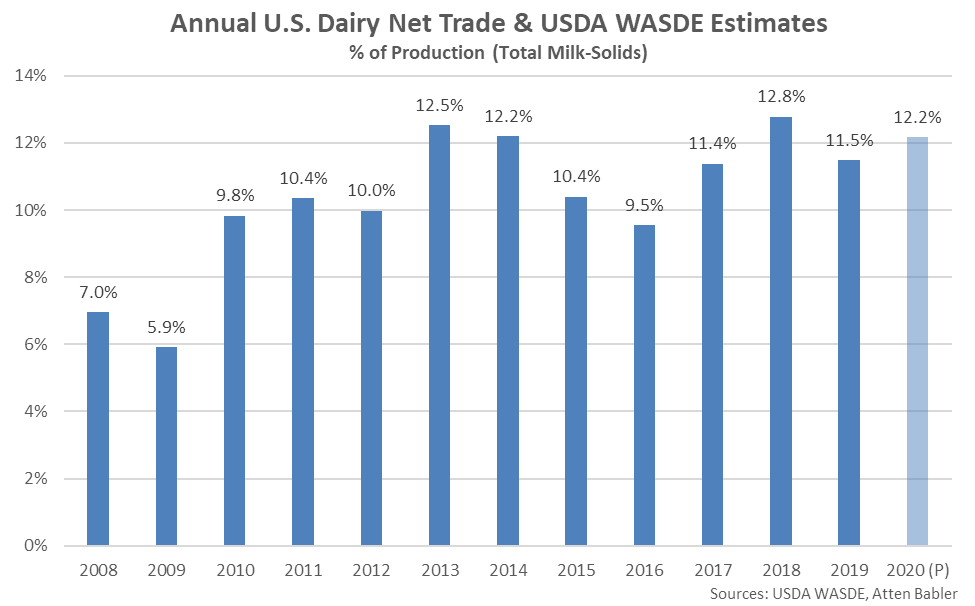

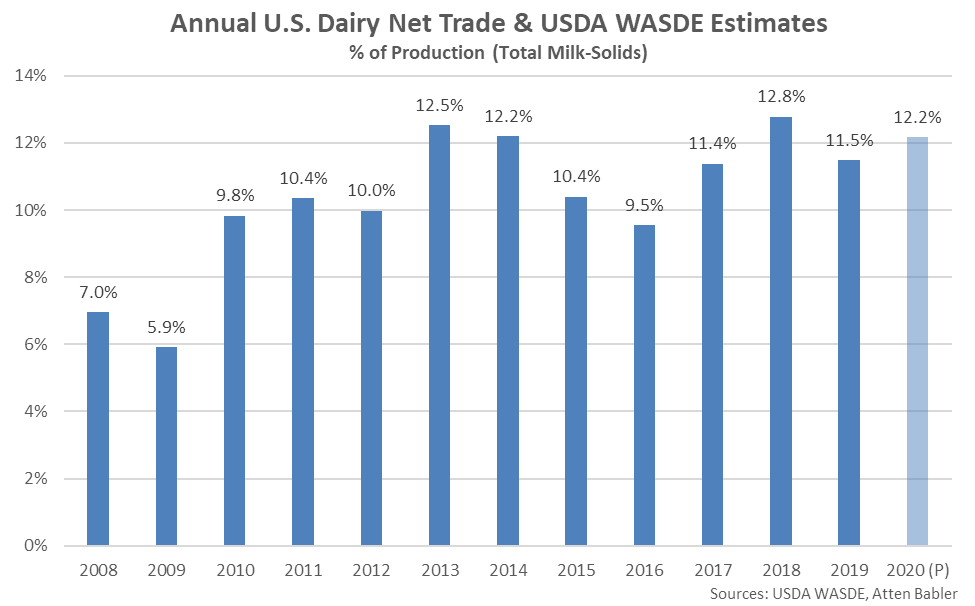

2020 projected dairy export volumes translated to 15.8% of total U.S. milk solids production while import volumes were equivalent to 3.6% of total U.S. milk solids production. 2020 net dairy trade is projected to rebound from the 2019 levels but remain below the 2018 record highs.

2020 dairy export forecasts were reduced from the previous month on a milk-fat basis on slower anticipated demand in the first half of the year but raised on a skim-solids basis on expectations of continued strength in international demand.

2020 dairy import forecasts were raised from the previous month on both a milk-fat and skim-solids basis on recent trade data and stronger anticipated imports of butterfat, cheese, milk proteins and several other dairy products.

2020 projected dairy export volumes translated to 15.8% of total U.S. milk solids production while import volumes were equivalent to 3.6% of total U.S. milk solids production. 2020 net dairy trade is projected to rebound from the 2019 levels but remain below the 2018 record highs.

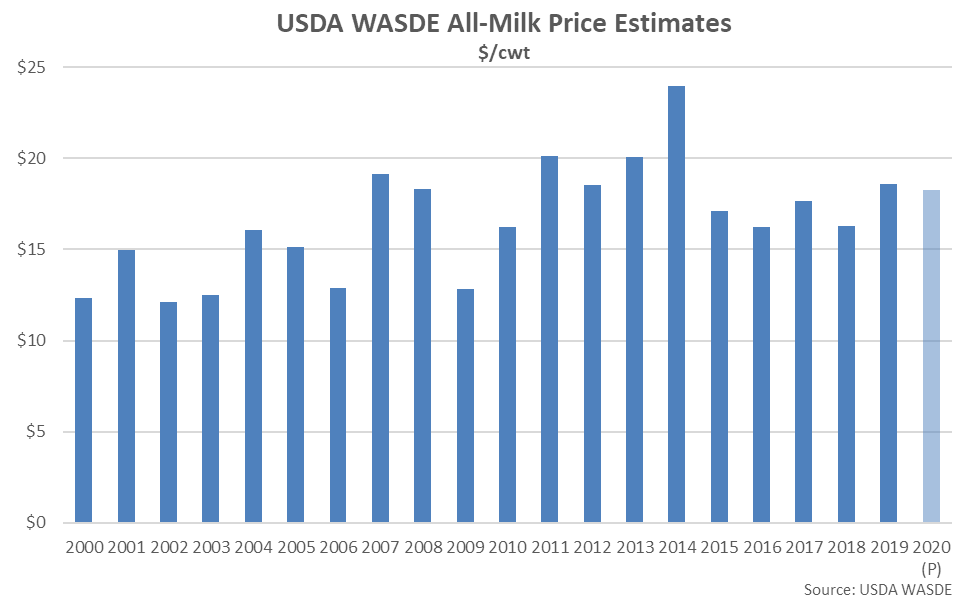

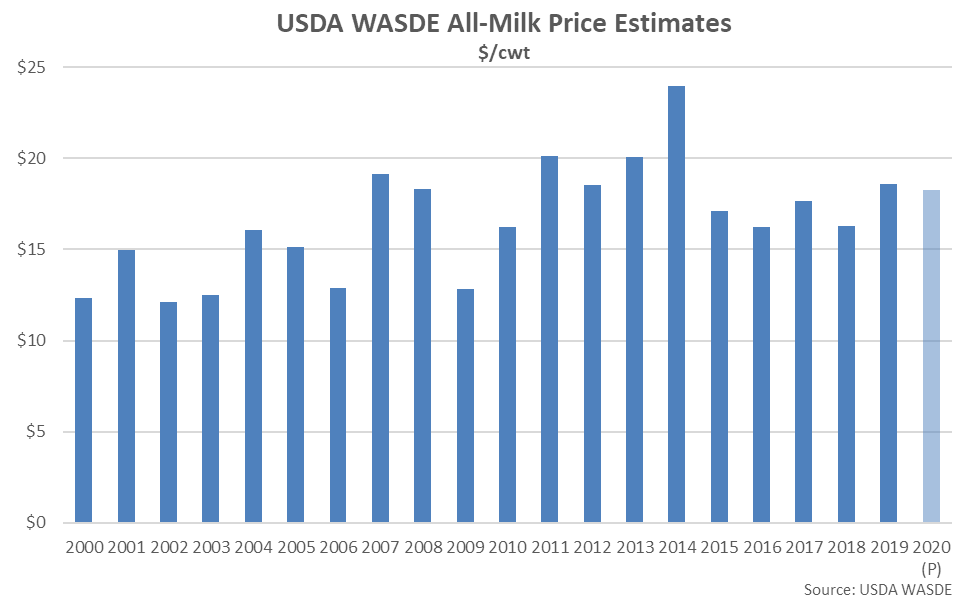

2020 butter, cheese and nonfat dry milk price forecasts were reduced from the previous month, however the dry whey price forecast was raised. The 2020 Class III milk price forecast of $16.65/cwt was reduced $0.30/cwt from the previous forecast, finishing at a seven month low projected level, while the 2020 Class IV milk price forecast of $15.75/cwt was reduced $0.95/cwt, finishing at the lowest projected level on record. The 2020 All-Milk price forecast of $18.25/cwt was reduced $0.60/cwt from the previous forecast, finishing 1.9% below 2019 price levels.

2020 butter, cheese and nonfat dry milk price forecasts were reduced from the previous month, however the dry whey price forecast was raised. The 2020 Class III milk price forecast of $16.65/cwt was reduced $0.30/cwt from the previous forecast, finishing at a seven month low projected level, while the 2020 Class IV milk price forecast of $15.75/cwt was reduced $0.95/cwt, finishing at the lowest projected level on record. The 2020 All-Milk price forecast of $18.25/cwt was reduced $0.60/cwt from the previous forecast, finishing 1.9% below 2019 price levels.

2020 dairy export forecasts were reduced from the previous month on a milk-fat basis on slower anticipated demand in the first half of the year but raised on a skim-solids basis on expectations of continued strength in international demand.

2020 dairy import forecasts were raised from the previous month on both a milk-fat and skim-solids basis on recent trade data and stronger anticipated imports of butterfat, cheese, milk proteins and several other dairy products.

2020 projected dairy export volumes translated to 15.8% of total U.S. milk solids production while import volumes were equivalent to 3.6% of total U.S. milk solids production. 2020 net dairy trade is projected to rebound from the 2019 levels but remain below the 2018 record highs.

2020 dairy export forecasts were reduced from the previous month on a milk-fat basis on slower anticipated demand in the first half of the year but raised on a skim-solids basis on expectations of continued strength in international demand.

2020 dairy import forecasts were raised from the previous month on both a milk-fat and skim-solids basis on recent trade data and stronger anticipated imports of butterfat, cheese, milk proteins and several other dairy products.

2020 projected dairy export volumes translated to 15.8% of total U.S. milk solids production while import volumes were equivalent to 3.6% of total U.S. milk solids production. 2020 net dairy trade is projected to rebound from the 2019 levels but remain below the 2018 record highs.

2020 butter, cheese and nonfat dry milk price forecasts were reduced from the previous month, however the dry whey price forecast was raised. The 2020 Class III milk price forecast of $16.65/cwt was reduced $0.30/cwt from the previous forecast, finishing at a seven month low projected level, while the 2020 Class IV milk price forecast of $15.75/cwt was reduced $0.95/cwt, finishing at the lowest projected level on record. The 2020 All-Milk price forecast of $18.25/cwt was reduced $0.60/cwt from the previous forecast, finishing 1.9% below 2019 price levels.

2020 butter, cheese and nonfat dry milk price forecasts were reduced from the previous month, however the dry whey price forecast was raised. The 2020 Class III milk price forecast of $16.65/cwt was reduced $0.30/cwt from the previous forecast, finishing at a seven month low projected level, while the 2020 Class IV milk price forecast of $15.75/cwt was reduced $0.95/cwt, finishing at the lowest projected level on record. The 2020 All-Milk price forecast of $18.25/cwt was reduced $0.60/cwt from the previous forecast, finishing 1.9% below 2019 price levels.