U.S. Dry Product Stocks Update – Jun ’15

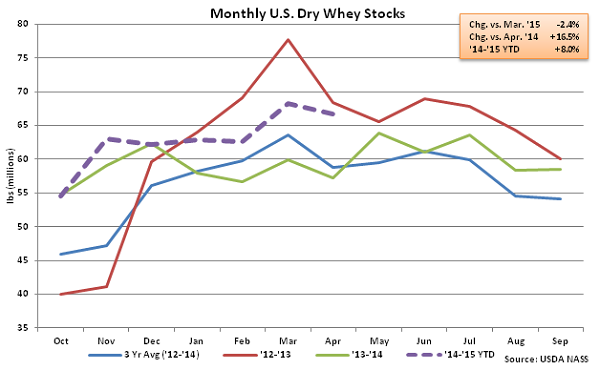

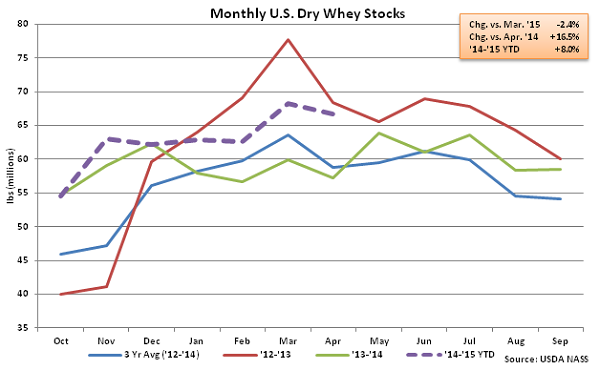

Dry Whey – Stocks Remain Higher on YOY Basis

Significant YOY increases in production have led to continued YOY growth in dry whey stocks. Apr ’15 dry whey stocks declined by 2.4%, or 1.6 million lbs, MOM but finished higher on a YOY basis for the fourth consecutive month. Apr ’15 dry whey stocks finished 16.5% higher than a year ago and 16.7% higher than the five year average April dry whey stocks.

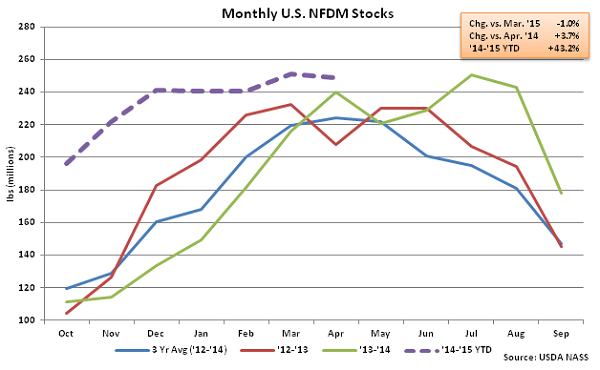

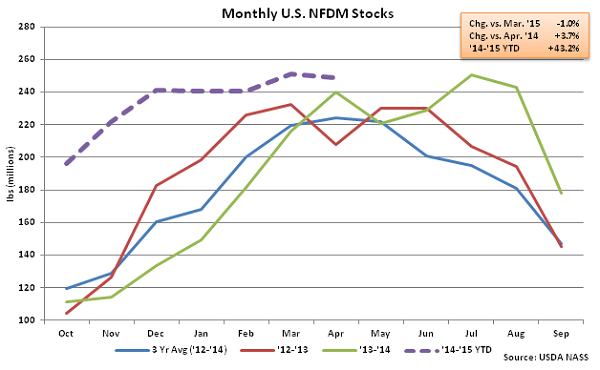

NFDM – Stocks Decline Slightly, Remain at Third Highest Level on Record

Continued growth in YOY NFDM production has led to stocks remaining at elevated levels. Apr ’15 NFDM stocks declined by 1.0%, or 2.6 million lbs, from the record high value experienced a month ago but remain at the third highest month ending figure on record. Apr ’15 NFDM stocks finished 3.7% higher than a year ago and 28.7% higher than the five year average April NFDM stocks.

NFDM – Stocks Decline Slightly, Remain at Third Highest Level on Record

Continued growth in YOY NFDM production has led to stocks remaining at elevated levels. Apr ’15 NFDM stocks declined by 1.0%, or 2.6 million lbs, from the record high value experienced a month ago but remain at the third highest month ending figure on record. Apr ’15 NFDM stocks finished 3.7% higher than a year ago and 28.7% higher than the five year average April NFDM stocks.

NFDM – Stocks Decline Slightly, Remain at Third Highest Level on Record

Continued growth in YOY NFDM production has led to stocks remaining at elevated levels. Apr ’15 NFDM stocks declined by 1.0%, or 2.6 million lbs, from the record high value experienced a month ago but remain at the third highest month ending figure on record. Apr ’15 NFDM stocks finished 3.7% higher than a year ago and 28.7% higher than the five year average April NFDM stocks.

NFDM – Stocks Decline Slightly, Remain at Third Highest Level on Record

Continued growth in YOY NFDM production has led to stocks remaining at elevated levels. Apr ’15 NFDM stocks declined by 1.0%, or 2.6 million lbs, from the record high value experienced a month ago but remain at the third highest month ending figure on record. Apr ’15 NFDM stocks finished 3.7% higher than a year ago and 28.7% higher than the five year average April NFDM stocks.