U.S. Livestock Cold Storage Update – Jun ’21

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through May ’21. Highlights from the updated report include:

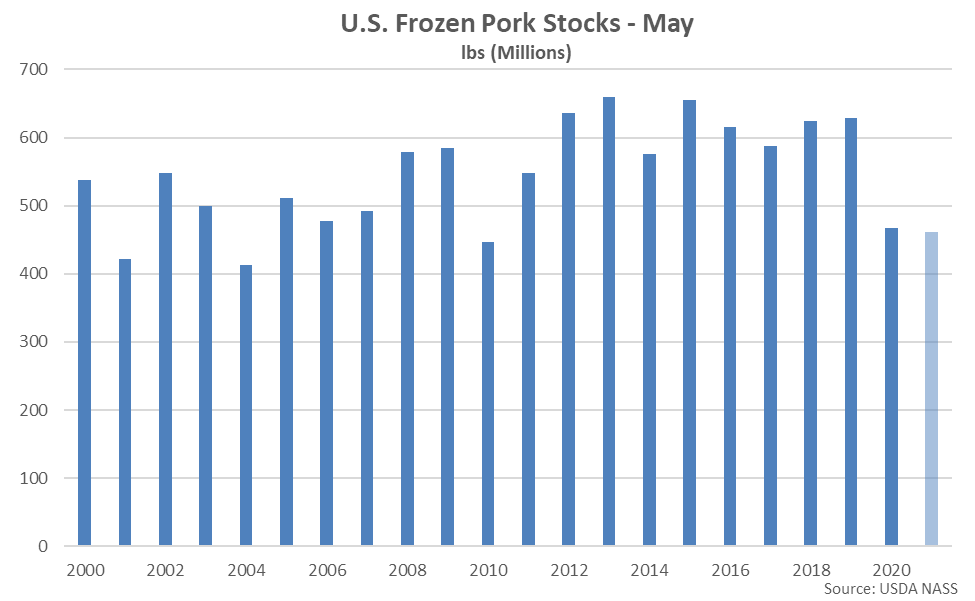

- U.S. pork stocks finished 1.5% below previous year volumes throughout May ’21, reaching an 11 year low seasonal level.

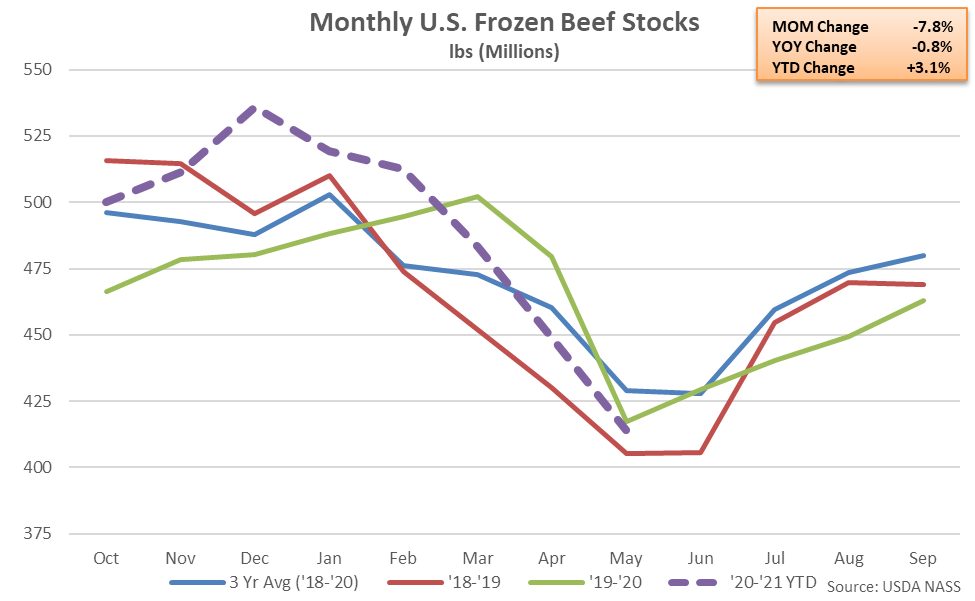

- U.S. beef stocks remained lower on a YOY basis for the third consecutive month throughout May ’21, finishing 0.8% below previous year levels. Beef stocks reached a 23 month low level, overall.

- U.S. chicken stocks remained at a seven year low seasonal level throughout May ’21, finishing 14.9% lower on a YOY basis.

Additional Report Details

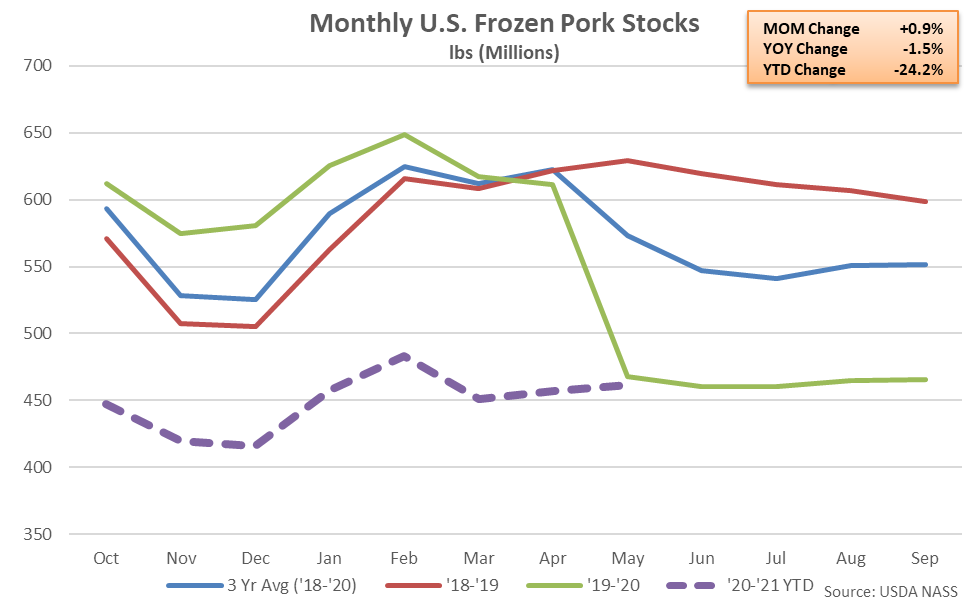

Pork – Stocks Reach an 11 Year Low Seasonal Level, Finish 1.5% Lower on a YOY Basis

According to the USDA, May ’21 U.S. frozen pork stocks rebounded slightly from the previous month but remained 1.5% below previous year volumes, reaching an 11 year low seasonal level. The YOY decline in pork stocks was the 14th experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the 14 most recent YOY declines. The month-over-month increase in pork stocks of 4.2 million pound, or 0.9%, was a contraseasonal move when compared to the ten year average April – May seasonal decline in stocks of 29.1 million pounds, or 4.5%.

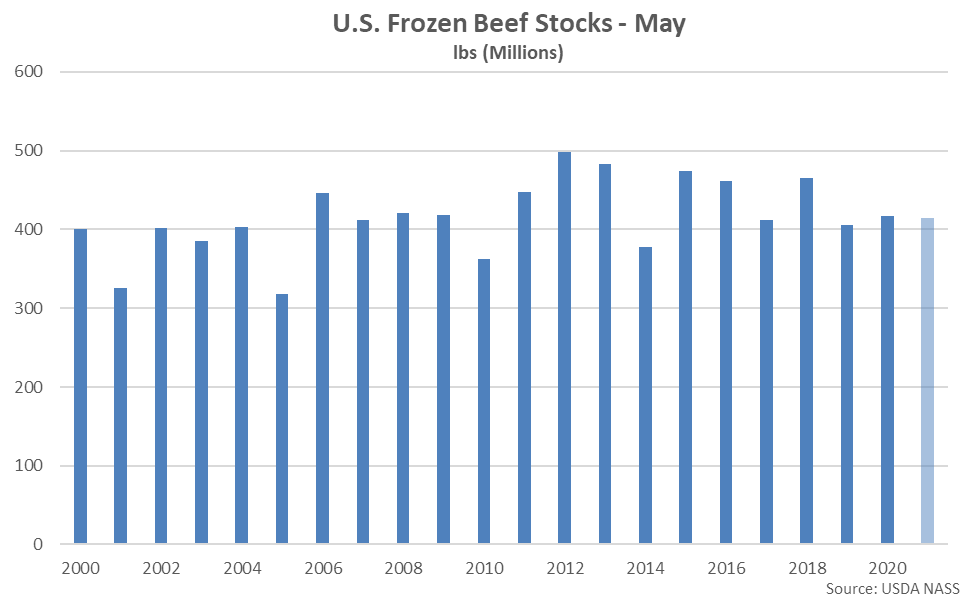

Beef – Stocks Remain Lower on a YOY Basis for the Third Consecutive Month, Finish Down 0.8%

May ’21 U.S. frozen beef stocks declined seasonally to a 23 month low level, finishing 0.8% below previous year volumes. The YOY decline in beef stocks was the third experienced in a row. The month-over-month decline in beef stocks of 34.8 million pounds, or 7.8%, was larger than the ten year average April – May seasonal decline in stocks of 22.4 million pounds, or 4.8%.

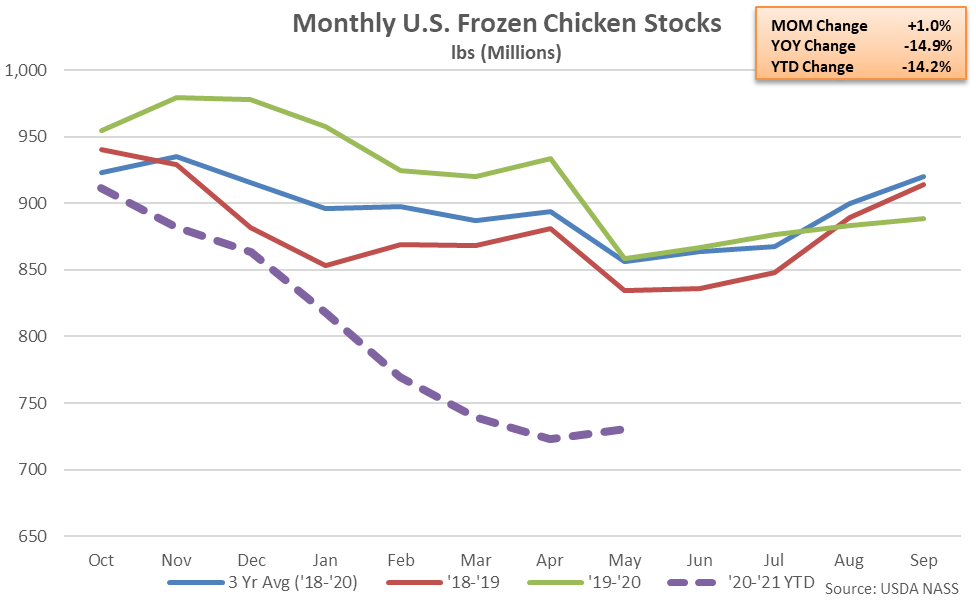

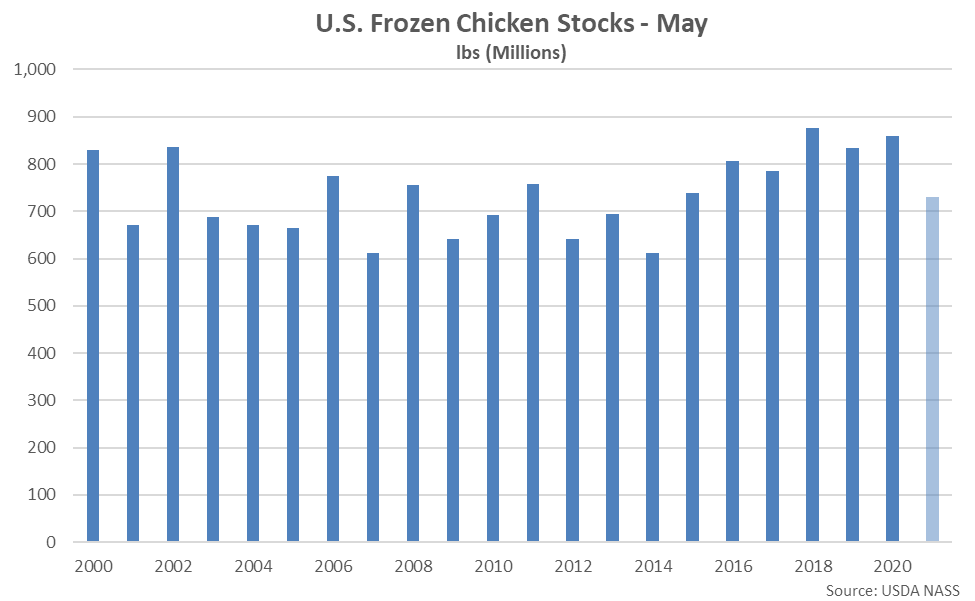

Chicken – Stocks Remain at a Seven Year Low Seasonal Level, Finish 14.9% Lower on a YOY Basis

May ’21 U.S. frozen chicken stocks rebounded slightly from the six year low level experienced throughout the previous month but remained 14.9% below previous year levels. Chicken stocks remained at a seven year low seasonal level for the month of May, finishing lower on a YOY basis for the tenth consecutive month. Chicken stocks had finished higher on a YOY basis over ten consecutive months prior to finishing lower over each of the past ten months. The month-over-month increase in chicken stocks of 7.2 million pounds, or 1.0%, was a contraseasonal move when compared to the ten year average April – May seasonal decline in stocks of 5.7 million pounds, or 0.2%.

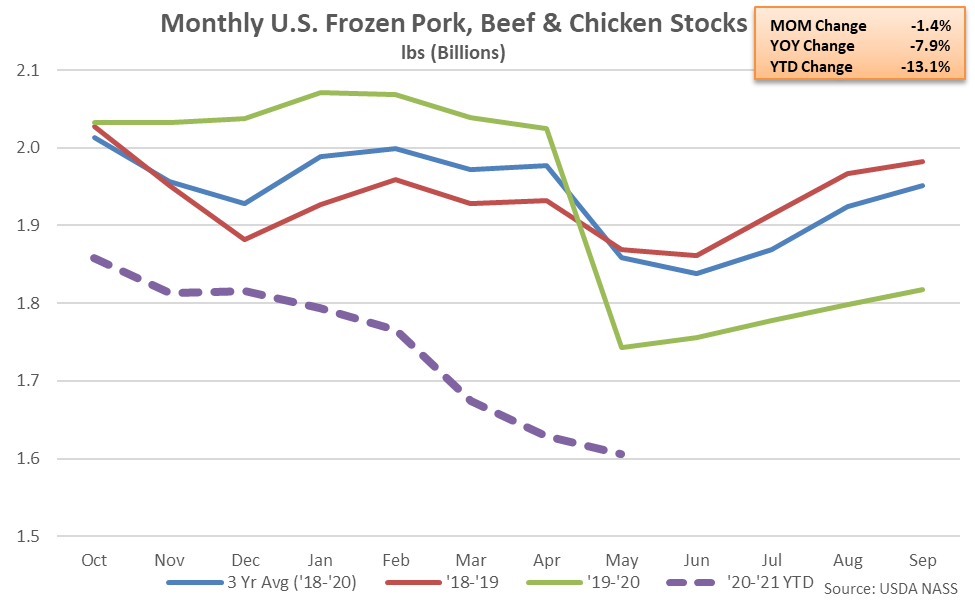

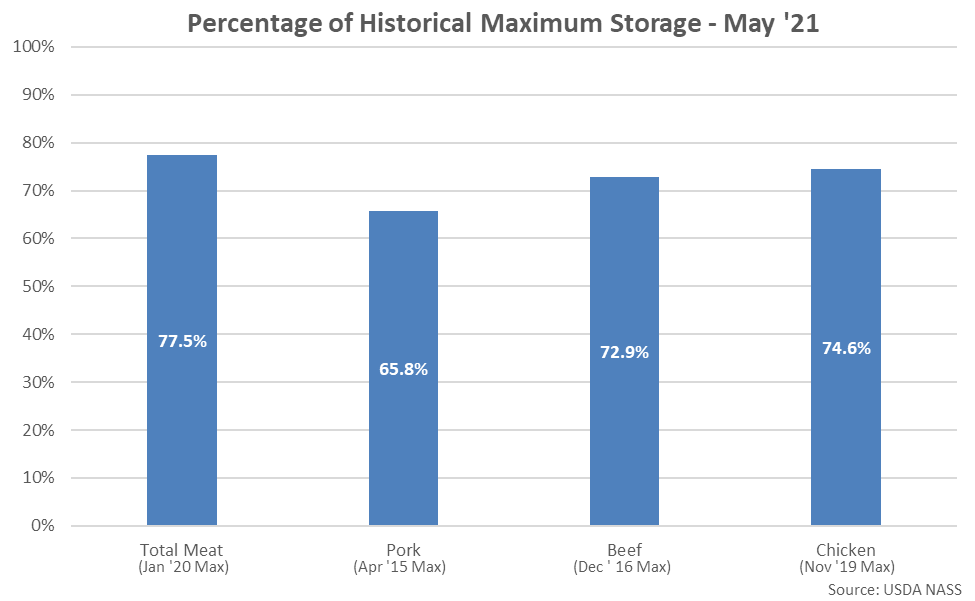

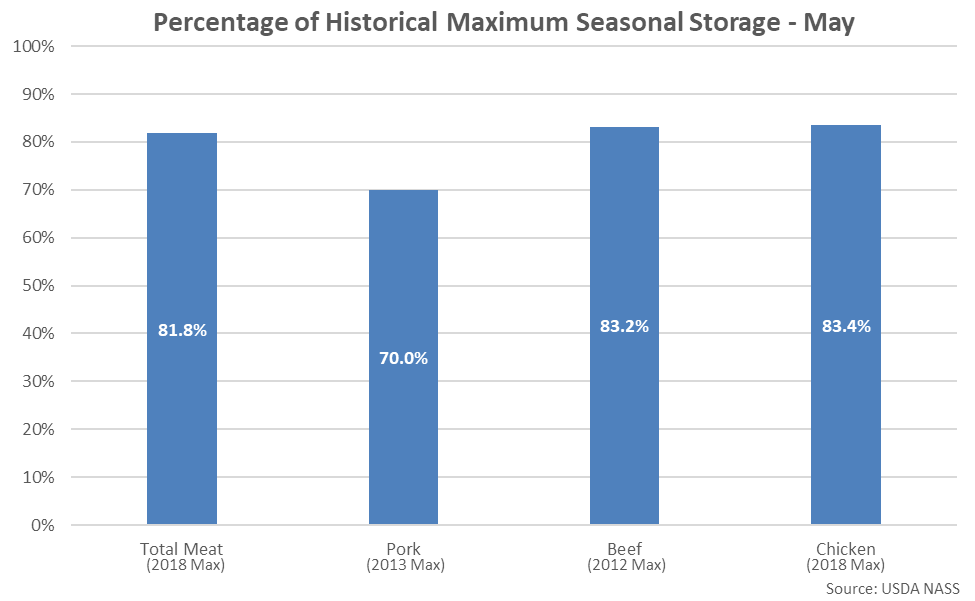

Overall, May ’21 combined U.S. pork, beef and chicken stocks finished 22.5% below the monthly record high level experienced throughout Jan ’20. Individually, May ’21 chicken stocks finished 25% below the record high historical storage level, while beef and pork stocks finished 27% and 34% below their respective maximum historical storage levels.

May ’21 combined U.S. pork, beef and chicken stocks declined to a seven year low seasonal level, finishing 18.2% below the record high seasonal level experienced during May of 2018. Individually, May ’21 chicken and beef stocks each finished 17% below their record high seasonal storage levels, while pork stocks finished 30% below the record high seasonal storage level.

The May ’21 YOY decline in combined U.S. pork, beef and chicken stocks was the 13th experienced in a row. Combined U.S. pork, beef and chicken stocks reached a six and a half year low level, overall.