Global Dairy Trade Results Update – 2/18/20

Executive Summary

Dairy product prices continued to decline during the GDT event held Feb 18th. Highlights from the most recent auction include:

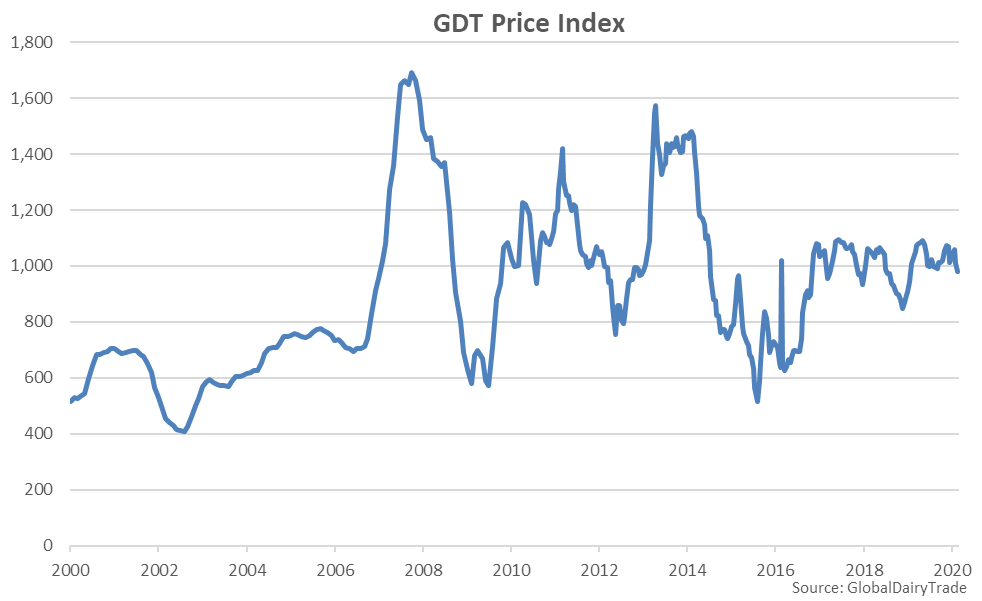

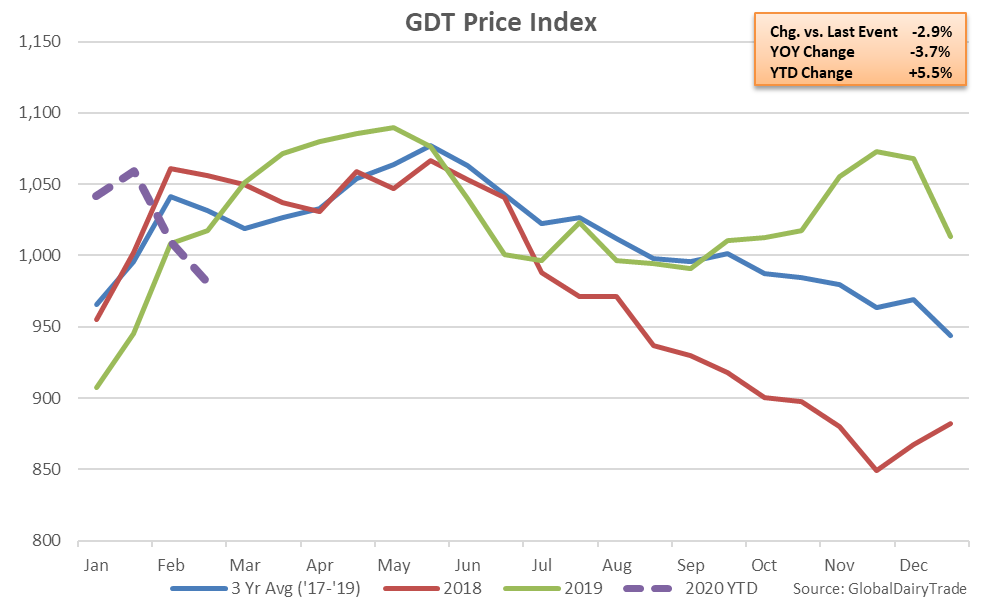

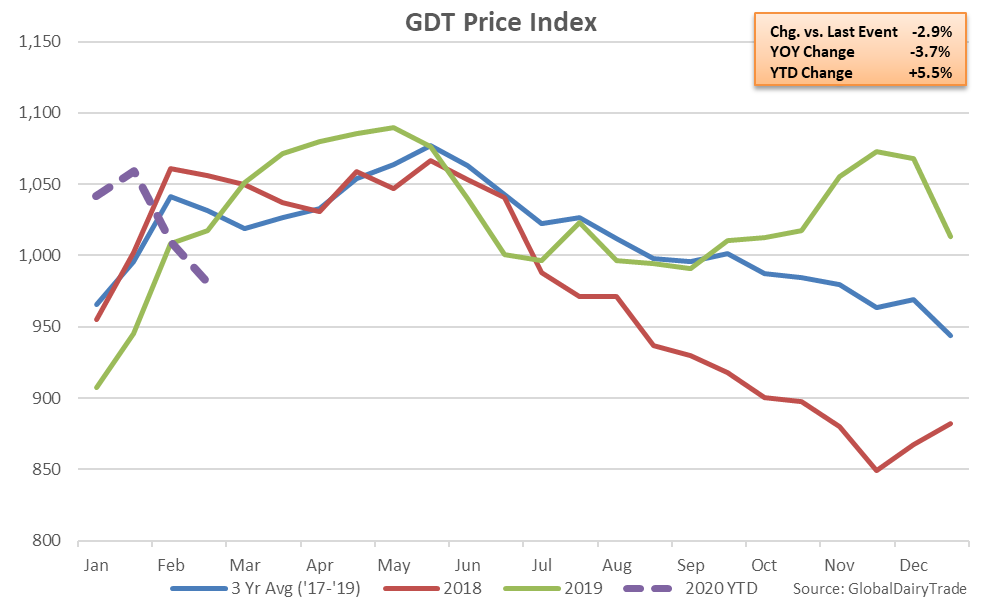

The GDT Price Index finished 3.7% below previous year price levels at the Feb 18th event, declining on a YOY basis for the first time in the past eight months. The GDT Price Index finished 4.9% below the three year average price for the second auction of February, finishing below three year average figures for the second consecutive event.

The GDT Price Index finished 3.7% below previous year price levels at the Feb 18th event, declining on a YOY basis for the first time in the past eight months. The GDT Price Index finished 4.9% below the three year average price for the second auction of February, finishing below three year average figures for the second consecutive event.

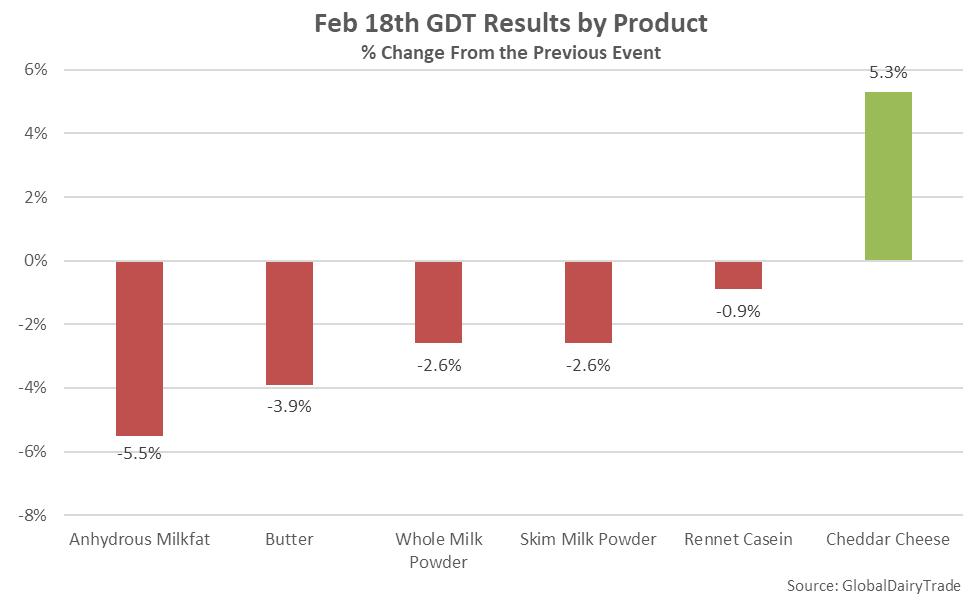

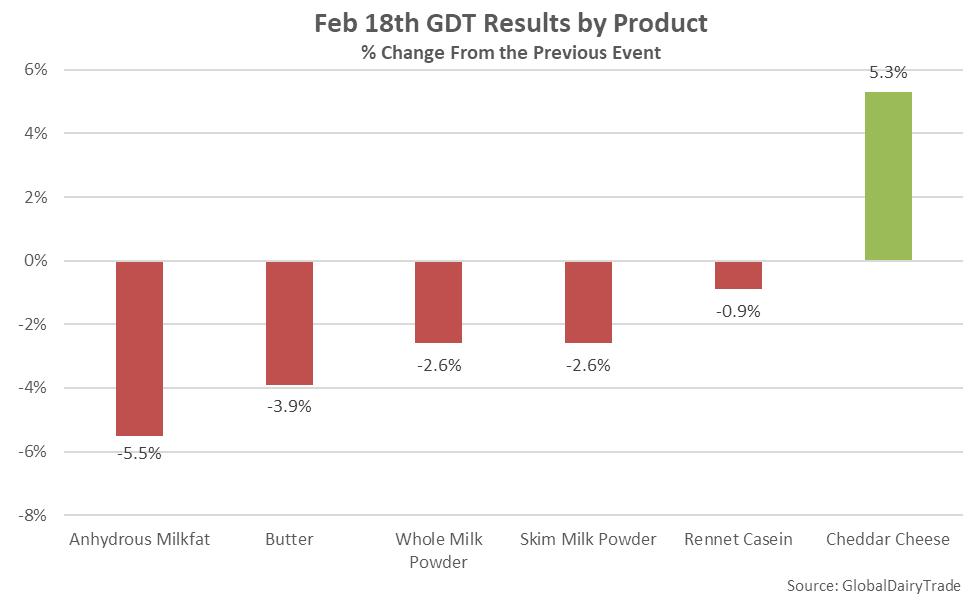

Within the latest auction, declines in prices were led by anhydrous milkfat (-5.5%), followed by butter (-3.9%), whole milk powder (-2.6%), skim milk powder (-2.6%) and rennet casein (-0.9%). The declines more than offset a 5.3% increase in cheddar cheese prices. Lactose, butter milk powder and sweet whey powder were not sold at the Feb 18th event. Whole milk powder prices declined to a 13 month low level as concerns over Chinese demand have been raised with the emergence of coronavirus. Over 90% of Chinese whole milk powder imports originated from within New Zealand throughout 2019.

Within the latest auction, declines in prices were led by anhydrous milkfat (-5.5%), followed by butter (-3.9%), whole milk powder (-2.6%), skim milk powder (-2.6%) and rennet casein (-0.9%). The declines more than offset a 5.3% increase in cheddar cheese prices. Lactose, butter milk powder and sweet whey powder were not sold at the Feb 18th event. Whole milk powder prices declined to a 13 month low level as concerns over Chinese demand have been raised with the emergence of coronavirus. Over 90% of Chinese whole milk powder imports originated from within New Zealand throughout 2019.

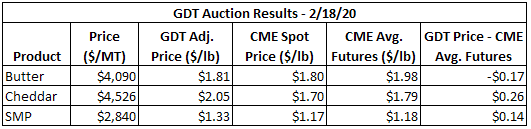

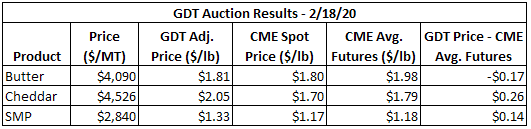

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Feb 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Feb 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

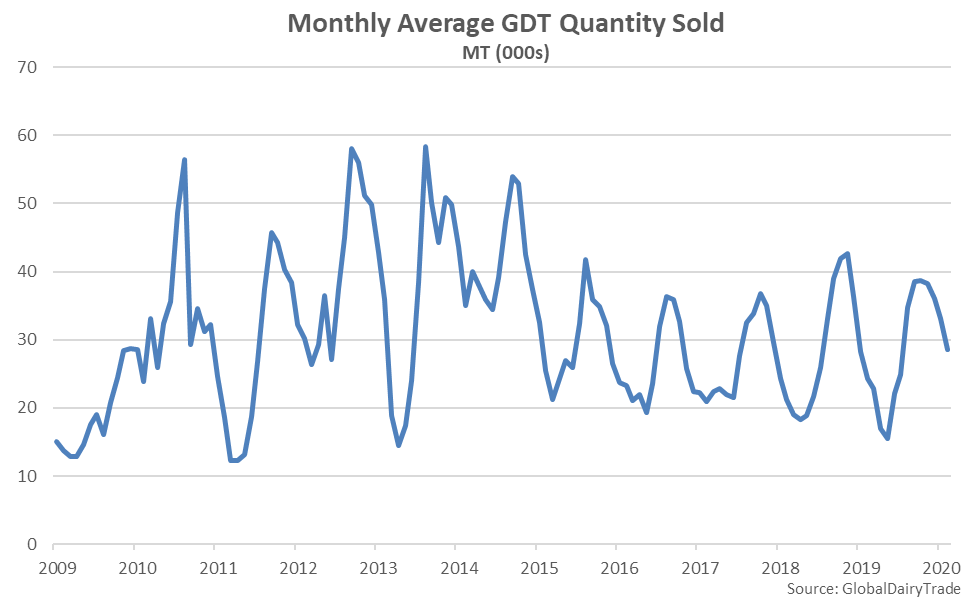

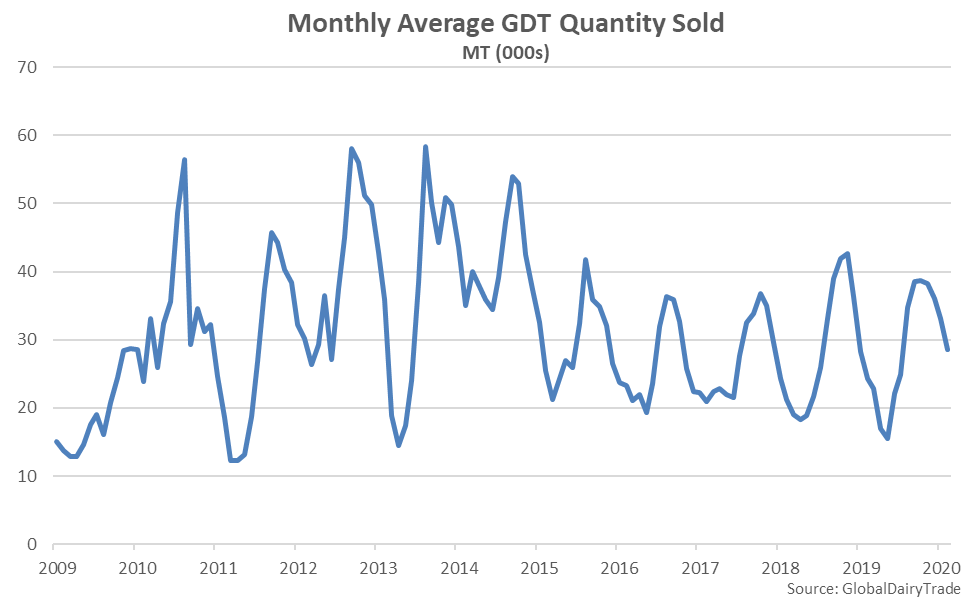

Total quantities sold for all products at the Feb 18th event declined 2.8% from the previous event but remained 11.3% higher on a YOY basis. The YOY increase in total quantities sold was the fourth experienced in a row.

Total quantities sold for all products at the Feb 18th event declined 2.8% from the previous event but remained 11.3% higher on a YOY basis. The YOY increase in total quantities sold was the fourth experienced in a row.

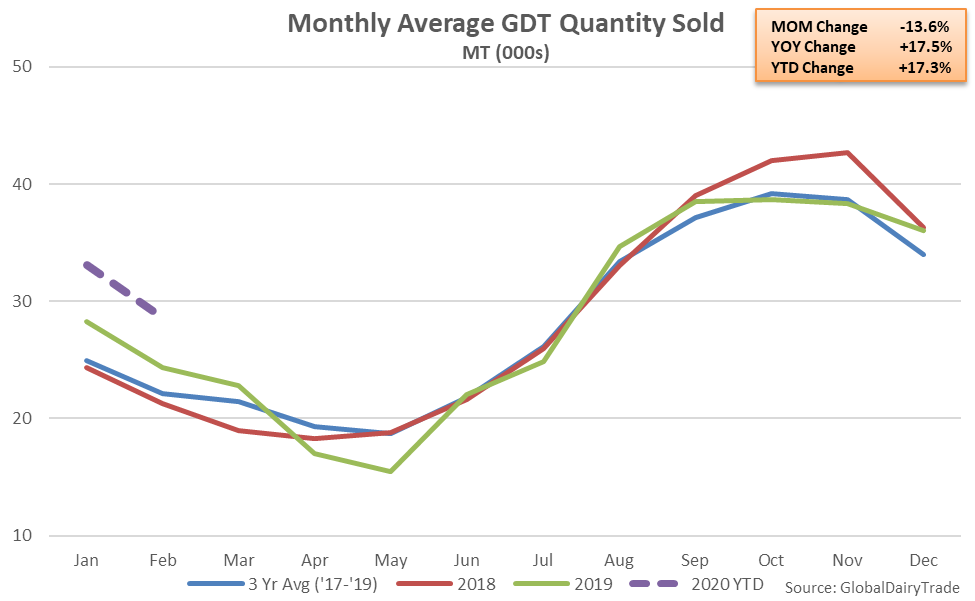

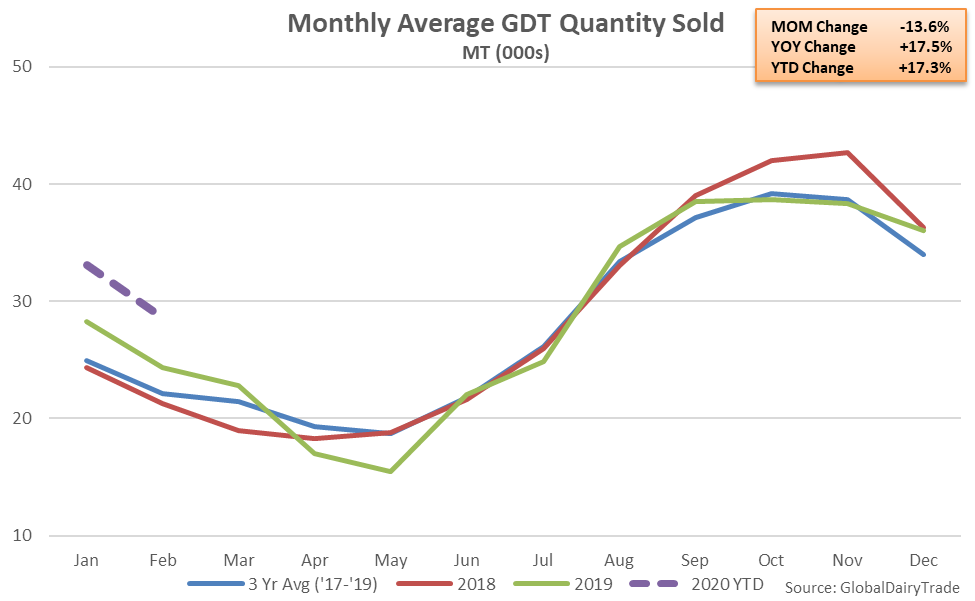

Volumes sold for all products within the February auctions declined 13.6% from average January volumes sold but finished 17.5% above last year’s average volumes sold for the month of February. Feb ’20 volumes sold for all products finished 29.1% above three year average seasonal figures, reaching a six year seasonal high level.

Volumes sold for all products within the February auctions declined 13.6% from average January volumes sold but finished 17.5% above last year’s average volumes sold for the month of February. Feb ’20 volumes sold for all products finished 29.1% above three year average seasonal figures, reaching a six year seasonal high level.

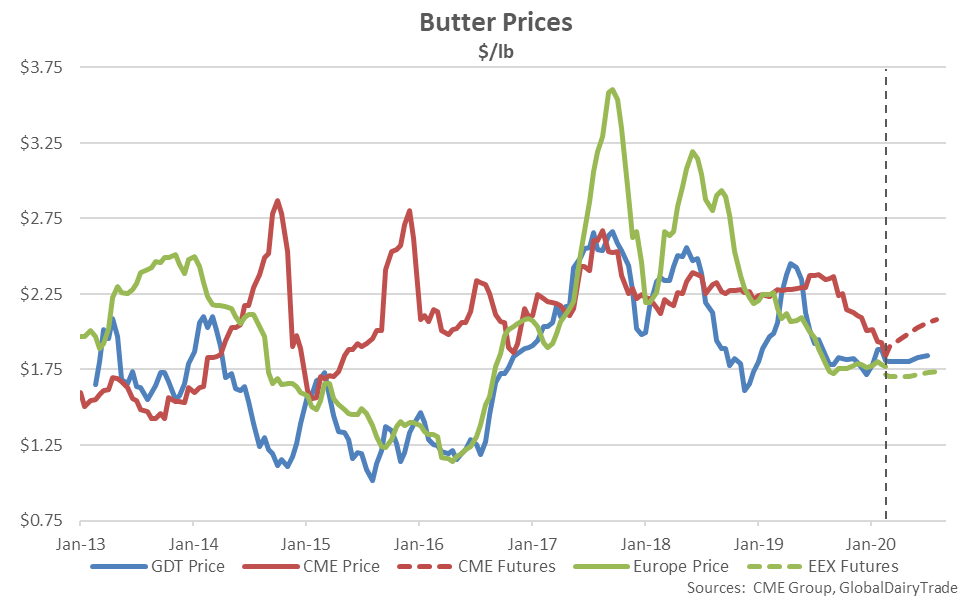

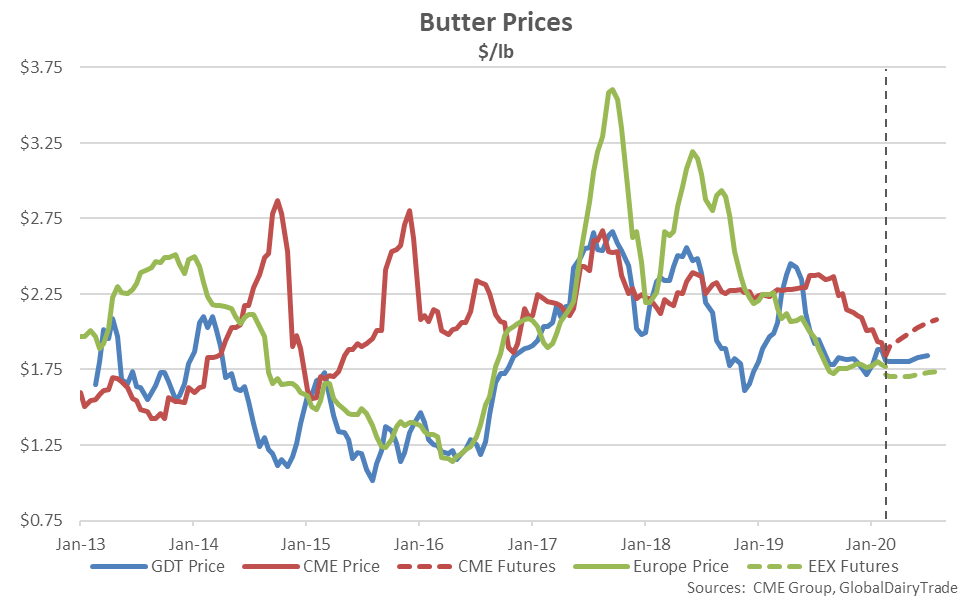

U.S. butter prices remained at a premium to GDT winning prices at the Feb 18th event as GDT butter prices declined from the six month high level experienced throughout the previous auction. U.S. spot butter prices are currently trading at a 0.5% discount to GDT prices however CME futures prices traded at a 9.4% premium to GDT prices from Mar ’20 – Jul ’20. Butter was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. butter prices remained at a premium to GDT winning prices at the Feb 18th event as GDT butter prices declined from the six month high level experienced throughout the previous auction. U.S. spot butter prices are currently trading at a 0.5% discount to GDT prices however CME futures prices traded at a 9.4% premium to GDT prices from Mar ’20 – Jul ’20. Butter was not sold at the GDT auction for Contract 6 (Aug ’20).

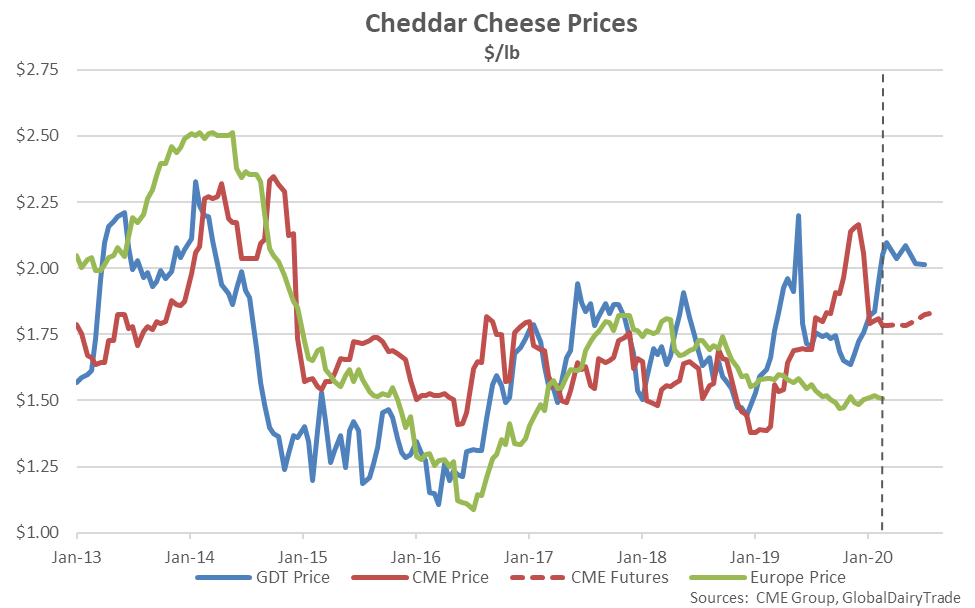

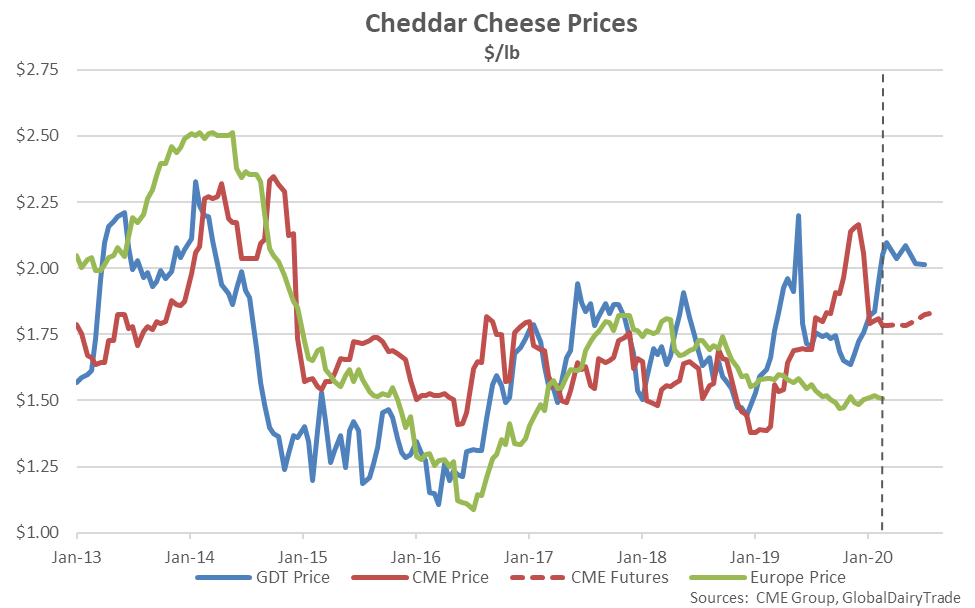

U.S. cheddar cheese prices finished at a discount to GDT winning prices at the Feb 18th event as GDT cheddar cheese prices increased to a nine month high level. U.S. spot cheddar cheese prices are currently trading at a 17.1% discount to GDT prices while CME futures prices traded at a 12.4% discount to GDT prices from Mar ’20 – Jul ’20. Cheddar cheese was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. cheddar cheese prices finished at a discount to GDT winning prices at the Feb 18th event as GDT cheddar cheese prices increased to a nine month high level. U.S. spot cheddar cheese prices are currently trading at a 17.1% discount to GDT prices while CME futures prices traded at a 12.4% discount to GDT prices from Mar ’20 – Jul ’20. Cheddar cheese was not sold at the GDT auction for Contract 6 (Aug ’20).

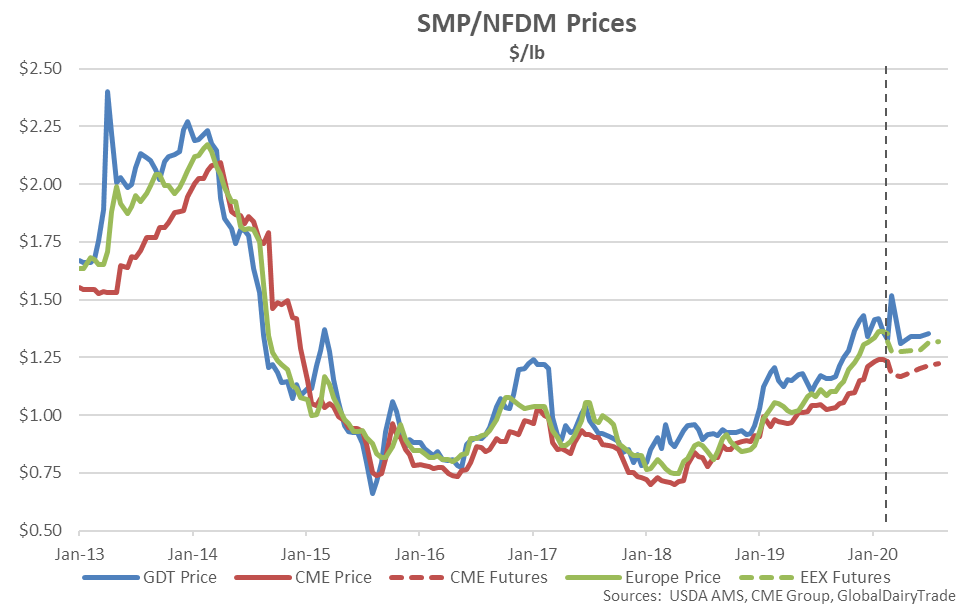

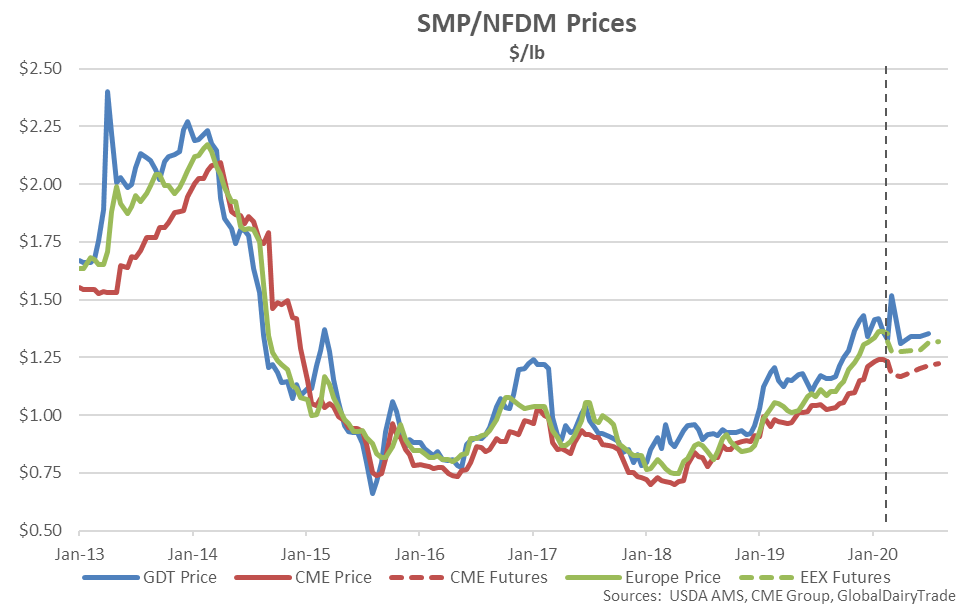

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Feb 18th event, despite GDT SMP prices declining to a four month low level. U.S. spot NFDM prices are currently trading at an 11.8% discount to GDT SMP prices while CME futures prices also traded at a 13.3% discount to GDT SMP prices from Mar ’20 – Jul ’20. SMP was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Feb 18th event, despite GDT SMP prices declining to a four month low level. U.S. spot NFDM prices are currently trading at an 11.8% discount to GDT SMP prices while CME futures prices also traded at a 13.3% discount to GDT SMP prices from Mar ’20 – Jul ’20. SMP was not sold at the GDT auction for Contract 6 (Aug ’20).

- The GDT Price Index declined 2.9% at the Feb 18th event, finishing at a 13 month low level. The GDT Price Index finished lower on a YOY basis for the first time in the past eight months, finishing down 3.7%.

- Declines in prices within the Feb 18th event were widespread across products offered with the exception of cheddar cheese prices, which increased to a nine month high level. Declines in prices were led by anhydrous milkfat, which declined to a three and a half year low level. Skim milk powder and whole milk powder prices declined to four and 13 month low levels, respectively, throughout the Feb 18th event.

- Total quantities sold for all products at the Feb 18th event declined seasonally from the previous event but remained higher on a YOY basis for the fourth consecutive event. Volumes sold for all products within the February auctions finished 17.5% above last year’s average volumes sold for the month of February and 29.1% above three year average seasonal figures, reaching a six year high seasonal level, overall.

The GDT Price Index finished 3.7% below previous year price levels at the Feb 18th event, declining on a YOY basis for the first time in the past eight months. The GDT Price Index finished 4.9% below the three year average price for the second auction of February, finishing below three year average figures for the second consecutive event.

The GDT Price Index finished 3.7% below previous year price levels at the Feb 18th event, declining on a YOY basis for the first time in the past eight months. The GDT Price Index finished 4.9% below the three year average price for the second auction of February, finishing below three year average figures for the second consecutive event.

Within the latest auction, declines in prices were led by anhydrous milkfat (-5.5%), followed by butter (-3.9%), whole milk powder (-2.6%), skim milk powder (-2.6%) and rennet casein (-0.9%). The declines more than offset a 5.3% increase in cheddar cheese prices. Lactose, butter milk powder and sweet whey powder were not sold at the Feb 18th event. Whole milk powder prices declined to a 13 month low level as concerns over Chinese demand have been raised with the emergence of coronavirus. Over 90% of Chinese whole milk powder imports originated from within New Zealand throughout 2019.

Within the latest auction, declines in prices were led by anhydrous milkfat (-5.5%), followed by butter (-3.9%), whole milk powder (-2.6%), skim milk powder (-2.6%) and rennet casein (-0.9%). The declines more than offset a 5.3% increase in cheddar cheese prices. Lactose, butter milk powder and sweet whey powder were not sold at the Feb 18th event. Whole milk powder prices declined to a 13 month low level as concerns over Chinese demand have been raised with the emergence of coronavirus. Over 90% of Chinese whole milk powder imports originated from within New Zealand throughout 2019.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Feb 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and skim milk powder (SMP) has been adjusted to 35% protein content (equivalent to U.S. nonfat dry milk) in the $/lb columns below. CME spot and average futures prices are based on Feb 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

Total quantities sold for all products at the Feb 18th event declined 2.8% from the previous event but remained 11.3% higher on a YOY basis. The YOY increase in total quantities sold was the fourth experienced in a row.

Total quantities sold for all products at the Feb 18th event declined 2.8% from the previous event but remained 11.3% higher on a YOY basis. The YOY increase in total quantities sold was the fourth experienced in a row.

Volumes sold for all products within the February auctions declined 13.6% from average January volumes sold but finished 17.5% above last year’s average volumes sold for the month of February. Feb ’20 volumes sold for all products finished 29.1% above three year average seasonal figures, reaching a six year seasonal high level.

Volumes sold for all products within the February auctions declined 13.6% from average January volumes sold but finished 17.5% above last year’s average volumes sold for the month of February. Feb ’20 volumes sold for all products finished 29.1% above three year average seasonal figures, reaching a six year seasonal high level.

U.S. butter prices remained at a premium to GDT winning prices at the Feb 18th event as GDT butter prices declined from the six month high level experienced throughout the previous auction. U.S. spot butter prices are currently trading at a 0.5% discount to GDT prices however CME futures prices traded at a 9.4% premium to GDT prices from Mar ’20 – Jul ’20. Butter was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. butter prices remained at a premium to GDT winning prices at the Feb 18th event as GDT butter prices declined from the six month high level experienced throughout the previous auction. U.S. spot butter prices are currently trading at a 0.5% discount to GDT prices however CME futures prices traded at a 9.4% premium to GDT prices from Mar ’20 – Jul ’20. Butter was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. cheddar cheese prices finished at a discount to GDT winning prices at the Feb 18th event as GDT cheddar cheese prices increased to a nine month high level. U.S. spot cheddar cheese prices are currently trading at a 17.1% discount to GDT prices while CME futures prices traded at a 12.4% discount to GDT prices from Mar ’20 – Jul ’20. Cheddar cheese was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. cheddar cheese prices finished at a discount to GDT winning prices at the Feb 18th event as GDT cheddar cheese prices increased to a nine month high level. U.S. spot cheddar cheese prices are currently trading at a 17.1% discount to GDT prices while CME futures prices traded at a 12.4% discount to GDT prices from Mar ’20 – Jul ’20. Cheddar cheese was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Feb 18th event, despite GDT SMP prices declining to a four month low level. U.S. spot NFDM prices are currently trading at an 11.8% discount to GDT SMP prices while CME futures prices also traded at a 13.3% discount to GDT SMP prices from Mar ’20 – Jul ’20. SMP was not sold at the GDT auction for Contract 6 (Aug ’20).

U.S. nonfat dry milk (NFDM) futures prices remained at a discount to GDT SMP winning prices at the Feb 18th event, despite GDT SMP prices declining to a four month low level. U.S. spot NFDM prices are currently trading at an 11.8% discount to GDT SMP prices while CME futures prices also traded at a 13.3% discount to GDT SMP prices from Mar ’20 – Jul ’20. SMP was not sold at the GDT auction for Contract 6 (Aug ’20).