Soybean Complex Crushing & Stocks Update – Mar ’20

Executive Summary

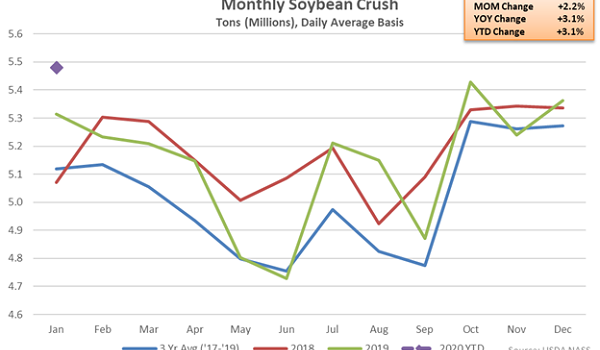

U.S. soybean crush and stocks figures provided by USDA were recently updated with values spanning through Jan ’20. Highlights from the updated report include:

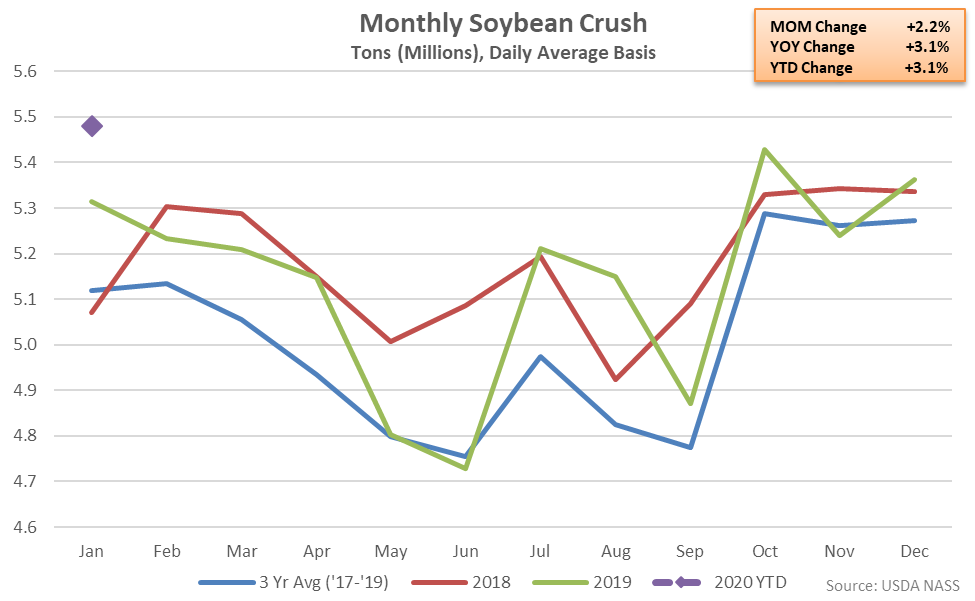

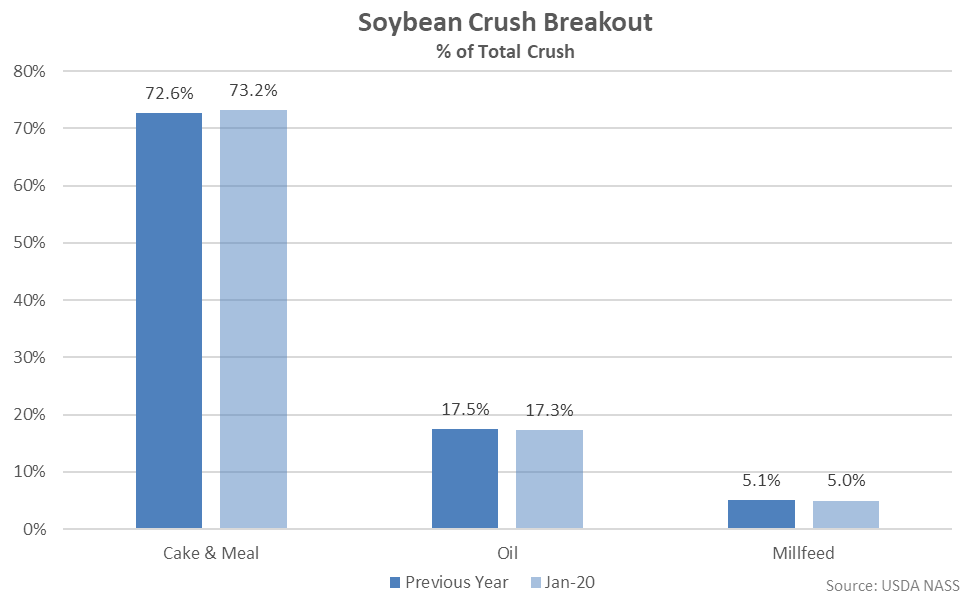

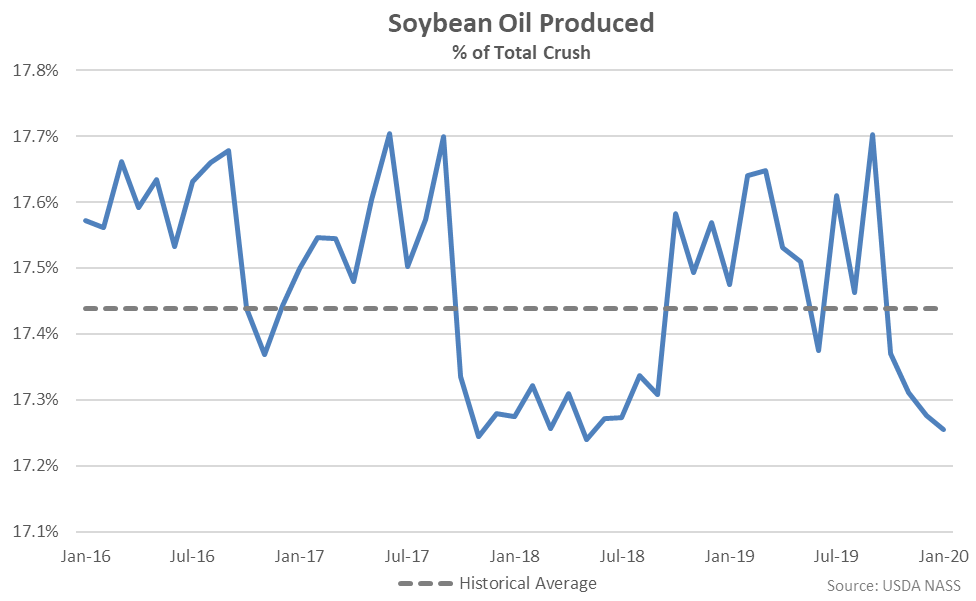

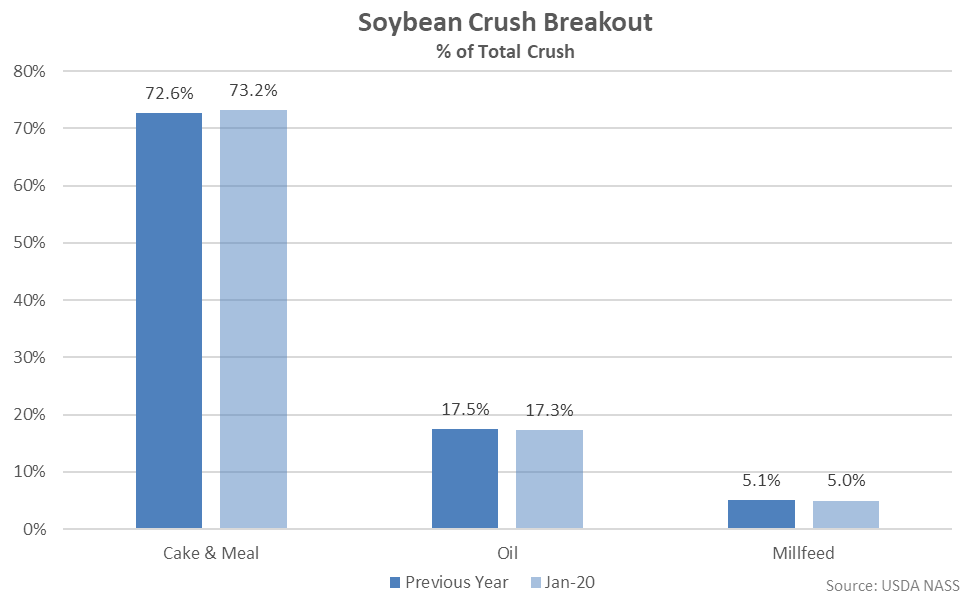

Cake & meal accounted for 73.2% of the total soybean crush throughout Jan ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.2% of the total soybean crush throughout Jan ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

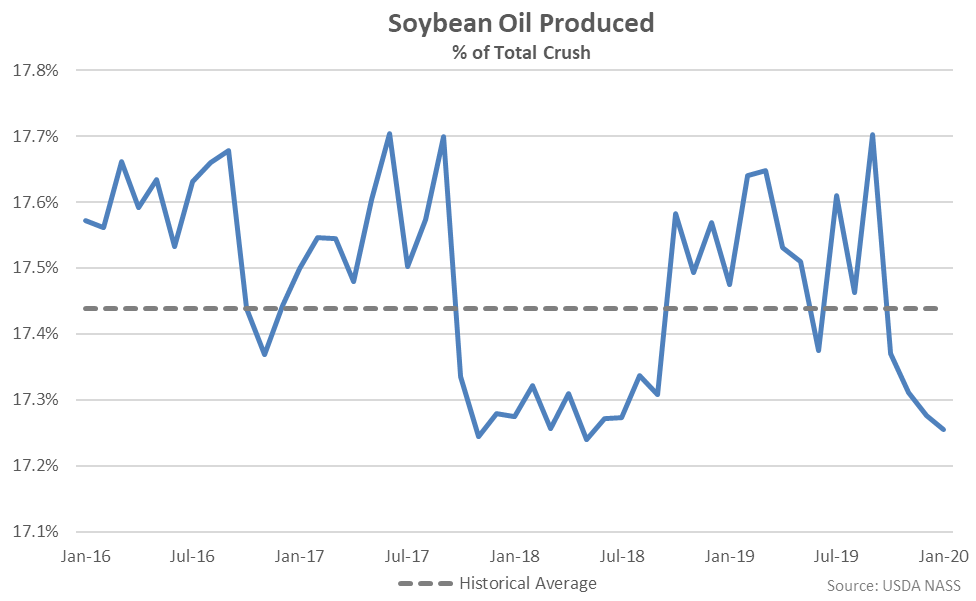

Jan ’20 soybean oil produced as a percentage of total crush declined to a 20 month low level, finishing below historical average figures for the fourth consecutive month.

Jan ’20 soybean oil produced as a percentage of total crush declined to a 20 month low level, finishing below historical average figures for the fourth consecutive month.

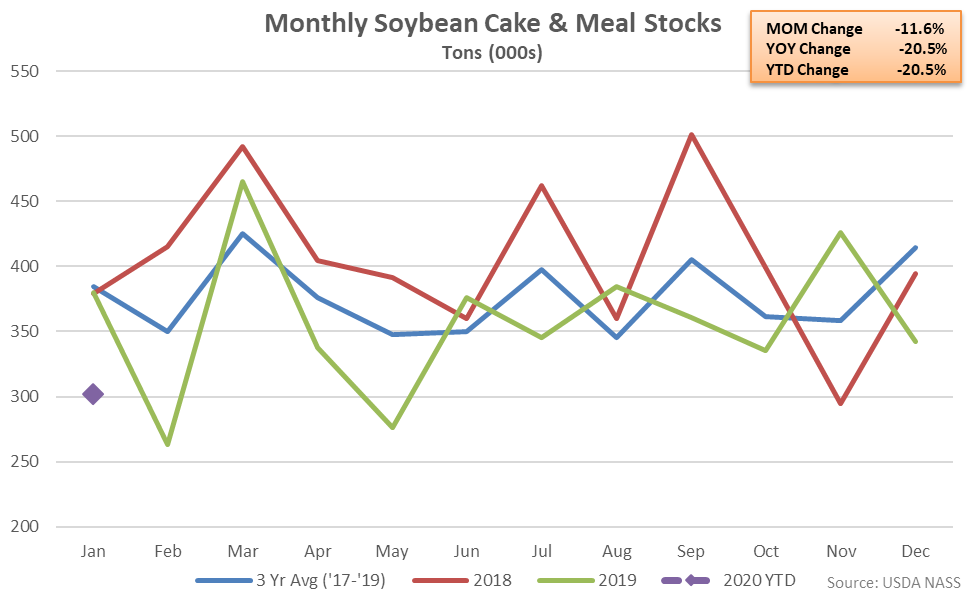

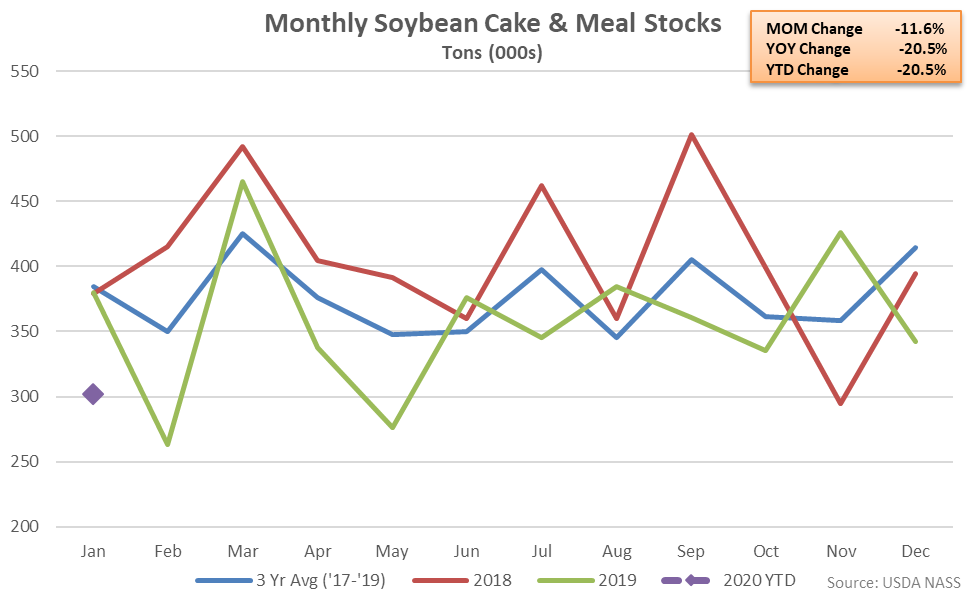

Soybean Cake & Meal Stocks – Stocks Finish 20.5% Lower YOY, Reach a Five Year Seasonal Low Level

Jan ’20 U.S. soybean cake & meal stocks declined 11.6% MOM and 20.5% YOY, finishing lower on a YOY basis for the fourth time in the past five months and reaching a five year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 11.6% was consistent with the three year December – January average seasonal decline in stocks of 10.3%. Jan ’20 soybean cake & meal stocks finished 21.4% below three year average seasonal levels.

Soybean Cake & Meal Stocks – Stocks Finish 20.5% Lower YOY, Reach a Five Year Seasonal Low Level

Jan ’20 U.S. soybean cake & meal stocks declined 11.6% MOM and 20.5% YOY, finishing lower on a YOY basis for the fourth time in the past five months and reaching a five year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 11.6% was consistent with the three year December – January average seasonal decline in stocks of 10.3%. Jan ’20 soybean cake & meal stocks finished 21.4% below three year average seasonal levels.

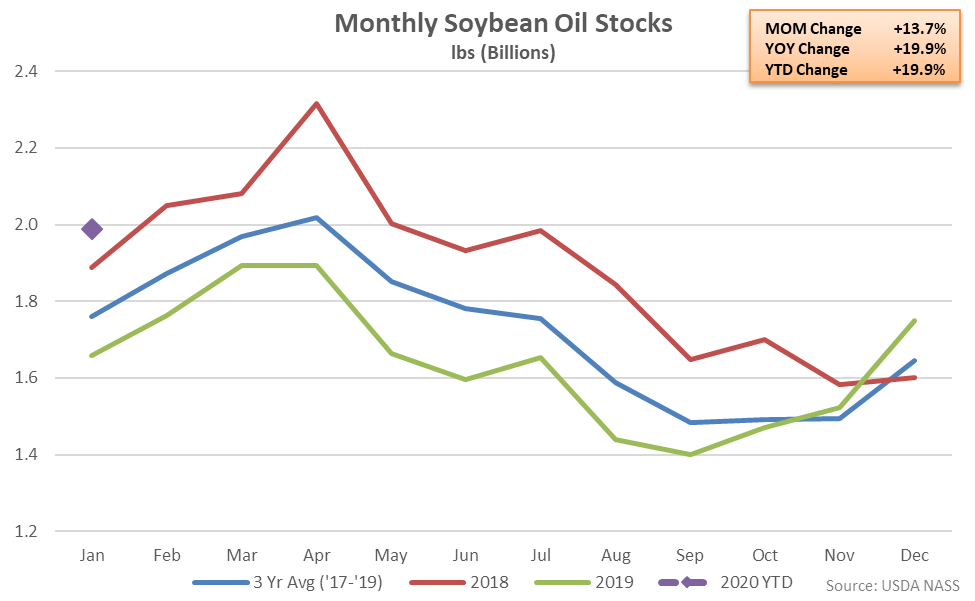

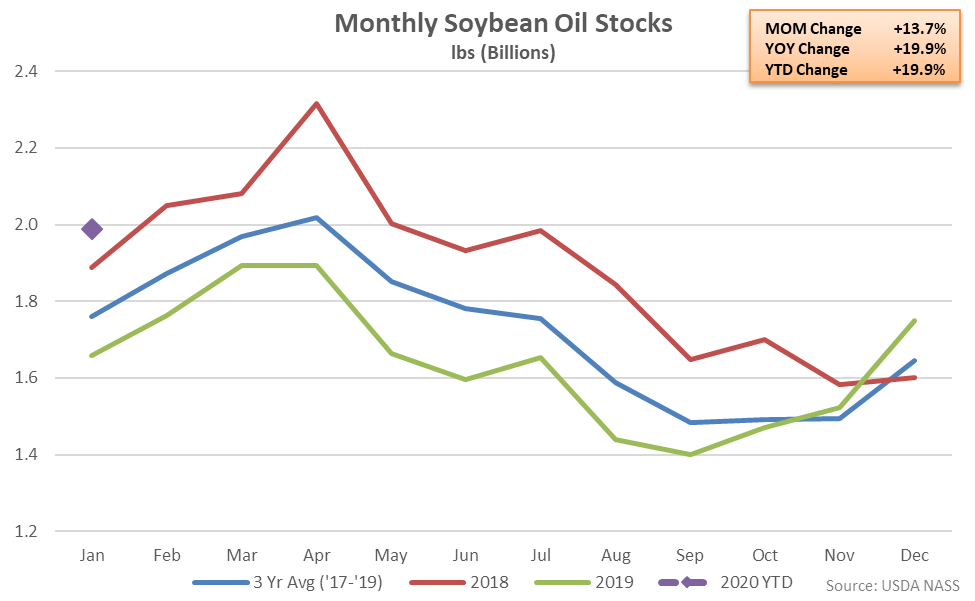

Soybean Oil Stocks – Stocks Finish 19.9% Higher YOY, Reach a Five Year Seasonal High Level

Jan ’20 U.S. soybean oil stocks increased 13.7% MOM to a 20 month high level while finishing 19.9% above previous year volumes and reaching a five year seasonal high level. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past two months. The month-over-month increase in soybean oil stocks of 13.7% was consistent with the three year December – January average seasonal build of 12.6%. Jan ’20 soybean oil stocks finished 13.1% above three year average seasonal levels, finishing higher for the third consecutive month.

Soybean Oil Stocks – Stocks Finish 19.9% Higher YOY, Reach a Five Year Seasonal High Level

Jan ’20 U.S. soybean oil stocks increased 13.7% MOM to a 20 month high level while finishing 19.9% above previous year volumes and reaching a five year seasonal high level. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past two months. The month-over-month increase in soybean oil stocks of 13.7% was consistent with the three year December – January average seasonal build of 12.6%. Jan ’20 soybean oil stocks finished 13.1% above three year average seasonal levels, finishing higher for the third consecutive month.

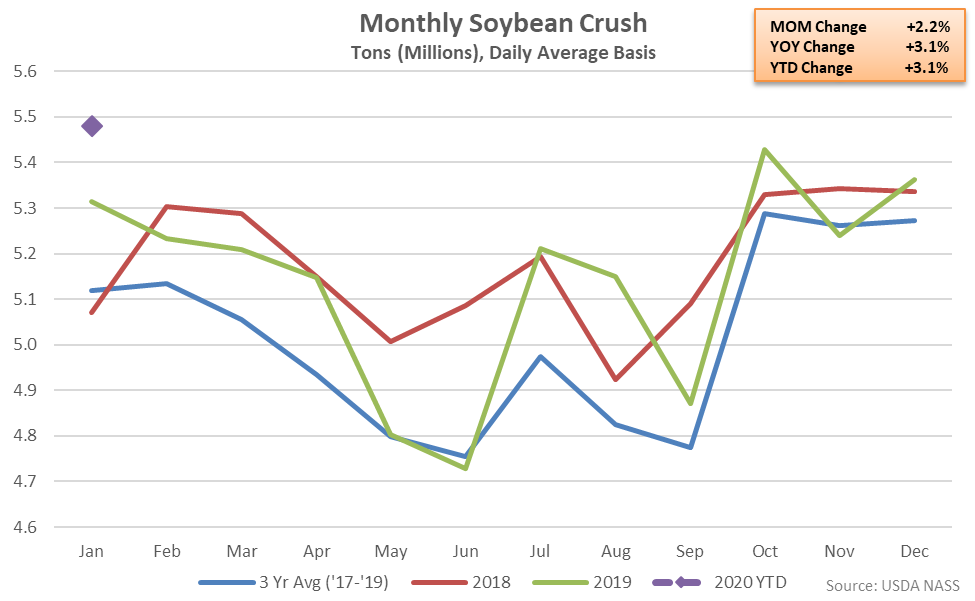

- U.S. soybean crushings increased 3.1% on a YOY basis during Jan ’20, reaching a record high seasonal level.

- U.S. soybean cake & meal stocks finished 20.5% lower on a YOY basis during Jan ’20, reaching a five year seasonal low level.

- U.S. soybean oil stocks finished 19.9% higher on a YOY basis during Jan ’20, reaching a five year high seasonal level.

Cake & meal accounted for 73.2% of the total soybean crush throughout Jan ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.2% of the total soybean crush throughout Jan ’20, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Jan ’20 soybean oil produced as a percentage of total crush declined to a 20 month low level, finishing below historical average figures for the fourth consecutive month.

Jan ’20 soybean oil produced as a percentage of total crush declined to a 20 month low level, finishing below historical average figures for the fourth consecutive month.

Soybean Cake & Meal Stocks – Stocks Finish 20.5% Lower YOY, Reach a Five Year Seasonal Low Level

Jan ’20 U.S. soybean cake & meal stocks declined 11.6% MOM and 20.5% YOY, finishing lower on a YOY basis for the fourth time in the past five months and reaching a five year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 11.6% was consistent with the three year December – January average seasonal decline in stocks of 10.3%. Jan ’20 soybean cake & meal stocks finished 21.4% below three year average seasonal levels.

Soybean Cake & Meal Stocks – Stocks Finish 20.5% Lower YOY, Reach a Five Year Seasonal Low Level

Jan ’20 U.S. soybean cake & meal stocks declined 11.6% MOM and 20.5% YOY, finishing lower on a YOY basis for the fourth time in the past five months and reaching a five year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 11.6% was consistent with the three year December – January average seasonal decline in stocks of 10.3%. Jan ’20 soybean cake & meal stocks finished 21.4% below three year average seasonal levels.

Soybean Oil Stocks – Stocks Finish 19.9% Higher YOY, Reach a Five Year Seasonal High Level

Jan ’20 U.S. soybean oil stocks increased 13.7% MOM to a 20 month high level while finishing 19.9% above previous year volumes and reaching a five year seasonal high level. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past two months. The month-over-month increase in soybean oil stocks of 13.7% was consistent with the three year December – January average seasonal build of 12.6%. Jan ’20 soybean oil stocks finished 13.1% above three year average seasonal levels, finishing higher for the third consecutive month.

Soybean Oil Stocks – Stocks Finish 19.9% Higher YOY, Reach a Five Year Seasonal High Level

Jan ’20 U.S. soybean oil stocks increased 13.7% MOM to a 20 month high level while finishing 19.9% above previous year volumes and reaching a five year seasonal high level. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past two months. The month-over-month increase in soybean oil stocks of 13.7% was consistent with the three year December – January average seasonal build of 12.6%. Jan ’20 soybean oil stocks finished 13.1% above three year average seasonal levels, finishing higher for the third consecutive month.